12 important and timely financial lessons 2021 has taught us

As we approach the end of the year, I’ve gone back through the newsletters you’ve received from me this year and pulled out some of the key lessons I’ve shared.

These might not give you all the answers you need to plan your financial future. Your situation is unique to you, and your financial planning process should be equally unique.

But following these lessons should stand you in good stead, and put you in a strong position to enjoy the retirement you deserve and have worked hard for.

So, in the spirit of the 12 days of Christmas, here are your 12 key financial lessons from 2021.

1. Inflation is one of the biggest threats to your financial wellbeing

In August, I wrote about the threat of inflation and what it means for you.

At the time, it was becoming increasingly clear that the inflation rate was likely to reach levels it hasn’t been at for nearly 30 years. In November, the Office of National Statistics confirmed that the inflation rate was 4.2% to October 2021.

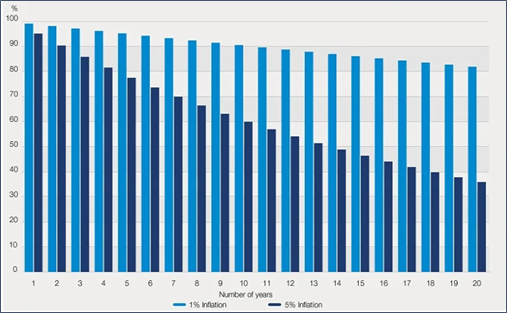

It’s now projected to reach 5% in 2022. That means £100 of your money a year ago will have lost its purchasing power and could only buy £95 of goods today. As you can see from the chart, year-on-year, 5% inflation can seriously affect the real value of your money.

Source: Schroders

So, it’s crucial to gear your investment strategy to mitigate the impact of inflation as far as possible.

2. You must have a plan, and stick to it

It’s hard to overstate the importance of planning when it comes to taking steps to protect your financial future.

Your plan doesn’t have to be too complicated to begin with, but it’s crucial to have one as it’s the roadmap that guides all your financial decision-making.

Without a plan you’ll be rudderless, and there’ll be little coherence to how you invest for your retirement.

3. Make sure you invest for the long term

In November, I shared my 10 investment commandments with you.

“Invest for the long term” was probably the most important.

If you’re not already investing money, the time to start is now. The sooner you’re in the market, the sooner your money can start to grow in value.

Then, once you’ve started investing, you should try to keep your money invested for as long as possible.

There’s an investment adage that says, “it’s time in the market, not timing the market”. That means that the length of time you invest will often have a far bigger impact on your success than when you buy or sell your holdings.

4. Increased longevity creates problems for financial planning

Increased longevity was the subject of one of my October articles.

Living longer means you get to spend more time with loved ones and have longer to do the things you dreamed of while you were working. But it can also mean fewer positive outcomes.

Your quality of life may be affected, as you may live longer with a serious but non-fatal illness.

This can affect your finances if you require long-term care.

Increased longevity can also pose challenges when it comes to your retirement income planning, and it’s important to be cognisant of the potential impact and take steps to mitigate this.

5. Wealth can be about you not having to worry about money

Back in October, you read about what “wealthy” means and how defining it can be key to your financial success.

Being wealthy doesn’t necessarily mean having more money. It’s more a question of better control over how you manage it.

Someone needing a lot of money to support their chosen way of life is more likely to be affected by external events – such as a stock market crash – that can have a detrimental effect on the value of their assets.

So, much depends on how you personally define wealth and being wealthy.

6. Not getting financial advice can be costly

The importance of financial advice has been a constant theme of mine throughout the year.

Research carried out by the International Longevity Centre has shown that those who take advice are, on average, more than £47,000 better off than those that don’t.

Additionally, leading investment fund managers, Vanguard Asset Management, have quantified the value of investment advice to be worth as much as 3% net each year.

7. Retirement doesn’t necessarily mean stopping work

The idea of working after you’ve retired is a relatively new concept. Our parents were part of the generation that saw retirement as a one-off event – stopping work on Friday and starting retirement on Monday.

The flexibility that Pension Freedoms allows you in terms of how you manage your pension fund means that more and more people are phasing in their retirement and happily working beyond their normal retirement age.

You may find this preferable to abruptly stopping work one day and starting your retirement the next.

8. You need to invest your money to beat inflation

Earlier this year you may have read a list of suggestions of how you could protect your retirement income from the threat of inflation.

Once you’ve stopped working, you won’t be earning any new money, so it’s essential to ensure that your investment strategy is robust enough to exceed the rate of inflation. You can put yourself in a far more secure position than if you’re just holding your money in cash.

Historically, stock markets have done a great job of delivering investors with returns above inflation. For example, over the last 10 years, the FTSE 100 has grown at an average of 7.6% each year and provided inflation-beating returns.

9. Using cashflow modelling can help you stay on track

Part of your planning process is to use the nearest thing we have to a crystal ball.

By regularly reviewing your financial future using an effective cashflow modelling tool, a financial planner can ensure your plans are on track.

We can also use the same modelling process to war-game certain events – such as a stock market crash – to ensure your financial plans are robust enough to cope with such an occurrence.

Again, this type of planning can save you the time you might have spent trying to do it yourself, or even just worrying about it.

10. Don’t overreact to events

Another one of my 10 investment commandments is not to react to every financial event. This is one of the big “don’ts” when it comes to investing your money.

If a particular fund or stock does well, then that’s great. You might want to quietly celebrate, but don’t get overconfident and assume that all your other trades will be equally successful.

Conversely, don’t panic if one particular investment choice shows poor returns.

Keep a level head and look at the long-term picture rather than react to every short-term movement.

11. Check your State Pension entitlement

The suspension of the triple lock in September prompted many people approaching retirement to consider the value of the State Pension.

At the current annual figure of £9,339 (2021/22 tax year), the current State Pension is probably not enough to live comfortably on. However, it is a handy, guaranteed income underpin for your retirement – maybe enough to pay your utility bills and food shopping. It also goes up each year in line with inflation.

There’s a government website where you can check how much State Pension you’ll be entitled to, and at what age you’ll start receiving it.

12. Reap the benefits of compound growth

Albert Einstein is alleged to have described compound interest as the “eighth wonder of the world”.

Returns on returns can provide much of your growth, especially when you take the addition of dividends to your investment fund value into account.

So, it’s important that you remain invested for the long term to take advantage of these benefits. It reiterates the point we made earlier about time in the markets being more important than when you buy and sell certain holdings.

Get in touch

If you want to talk through your own financial plans and find out how I can help you, please give me a call on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation & Trust advice and Will writing.