8 key facts to consider when it comes to understanding investment risk

The value of your investments, particularly your pension fund, is crucial to the success of your financial planning.

A key factor when it comes to growth on your investments is the amount of risk you’re prepared to accept to meet your financial goals.

Here are eight key facts about investment risk that you should consider when you’re investing your money.

1. It’s important you understand what “risk” is

From crossing the road to buying a new car, there is an element of risk involved in almost everything you do.

Each time you do something that could be risky, you’ll take steps to reduce that risk. So, when you’re crossing the road, you’ll check for oncoming traffic. If you’re buying a new car, you’ll research what you’re buying and take a test drive to reduce the chances of buying something unsuitable for your needs.

You can avoid risk totally by not crossing the road, or not buying a new car. But, ultimately, the decisions you make are generally driven by accepting a certain level of risk to get what you want.

When it comes to investing your money into savings or your pension fund, “risk” is the downside you need to be prepared to accept to get a better return on your money than leaving it in a bank account.

There are different levels of investment risk, and various ways you can manage your investment strategy to reduce the level of risk to your money.

2. Investment values will rise and fall

If you want the value of your money to increase at a better rate than the current, derisory rates of interest being paid on savings accounts, you should consider investing it. An appropriate way could be to do this in investment funds, or individual stocks and shares.

The nature of stock markets means that they rise and fall. Accepting that fact is integral to understanding risk and a key step towards long-term investment success.

The more risk you accept when you’re investing, the more chance you have of increased returns. But, against that, by taking on more risk you’re increasing the chances of fluctuation in the value of your holdings.

3. The risk of losing your capital has a lot to do with how you behave

One of the most common investment adages you’ll hear is “time in the market, not timing the market”.

This means that it’s difficult to buy and sell investments at the right time to maximise your profits. You’re more likely to achieve consistent returns by simply keeping your money invested over a longer period.

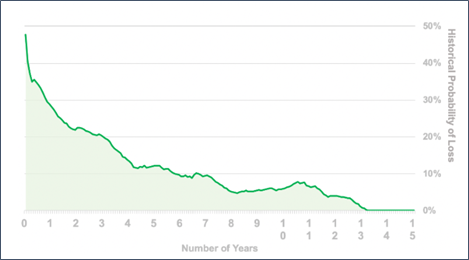

The chart below uses historical data going back nearly 50 years to show that holding a random stock or share for a period of over 14 years can potentially reduce your chances of losing money to virtually zero.

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 1 January 1971-20 May 2020

By leaving your investments to grow over an extended period, you’re more likely to be successful than if you’re reacting to every market movement.

By continually adjusting your investment holdings and selling investments at a lower price than you paid for them when markets fall, you’ll be crystallising losses and losing capital.

You’re often better off ignoring your investments totally. Clearly this can be difficult. We’re bombarded with investment news on a daily basis – from tips in the media to each news bulletin telling us what happened on the London Stock Exchange today.

You can also check the value of your holdings at the touch of a button.

But by tuning out the daily noise, you’ll allow markets to do what they have always done and recover from falls and show a potential long-term growth over extended periods.

4. Market volatility is actually your friend, not your enemy

It may sound counter-intuitive, but volatility can be a good thing, rather than something for you to fear.

This is because when markets fall, you can often buy more stocks because the price will be lower. This can increase your chances of growth.

This is why regular contributions into investments such as your pension fund can be so effective. If and when markets fall, you’re buying holdings at a cheaper price.

5. The more risk you can accept, the better your chance of higher growth

You can potentially earn higher returns on your investments by taking on more risk.

But it won’t be a smooth ride of upwards growth. Your portfolio will almost certainly go up and down along the way. Sometimes, the change in value could be dramatic. It’s how much fluctuation you’re happy to deal with that determines your attitude to risk.

Remember, everyone’s risk tolerance is different. Some people are naturally more cautious than others, and this is likely to extend into all factors of your life, including how you invest your money.

The secret is finding a balance between what you’re comfortable with and what you need to be able to achieve the required investment returns to meet your goals.

Being realistic about what you’re expecting to gain might help you work out the kind of risk you’d have to take on to get there and whether you’ll have to adjust your expectations.

6. Ignorance can be bliss

According to This is Money, the average price of residential property trebled in the first 20 years after the millennium.

So, on average, a property worth £100,000 in 2000 would have been worth £300,000 by 2020.

Over the same period, the annualised total return of the FTSE 100 was 6.9%, assuming reinvestment of dividends. So £100,000 invested in 2000 would be worth £395,000 by 2020.

These figures mean that the FTSE 100 outperformed property prices by over 30% over that 20-year period.

Yet it’s often house price inflation that gets the positive headlines, while stock market performance usually only makes headlines when there’s a market crash.

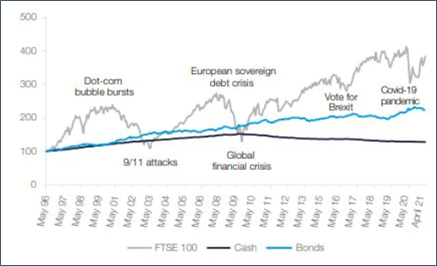

In fact, as you can see from the chart below, there were a series of severe stock market falls in that 20-year period, including the dot-com bubble bursting, the global financial crisis, and the Covid pandemic. Even after all that fluctuation, the market still outperformed “safer” investment options, such as leaving money in cash or low-risk bonds.

Source: Brewin Dolphin / Datastream

People express pleasant surprise when they realise how much their family home has appreciated in value by, but that’s because you tend not to get your house valued every couple of months as you can do with your investment funds.

By ignoring the value of your pension and just continuing to pay in as much as you can afford, it’s likely you’ll be as equally surprised by the growth in value as someone finding out the current value of their house.

7. Reinvestment of dividends is crucial for long-term growth

The key factor in the stock market outperforming property price inflation that we highlighted in the previous section is the reinvestment of dividends.

Reinvesting dividends is one of the keys to growing your long-term wealth. This is due to an effect known as “compounding”. This is where dividends are reinvested, and you essentially benefit from “growth on growth”. Over time, the power of compounding starts to make a large impact on the value of your portfolio.

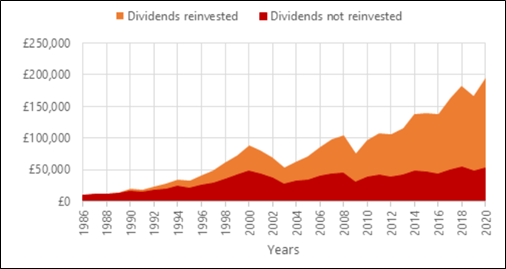

This is illustrated in the chart below, showing the impact of dividend reinvestment on an initial £10,000 investment from 1986 to 2020.

Source: IG.com

8. One of the biggest risks is the impact of inflation

Rather than being spooked by daily movements in the stock market – which have little impact on a portfolio over the long term – a much bigger threat to be aware of is the erosion in the real value of your money through inflation.

The Office for Budget Responsibility (OBR) have recently estimated that the inflation rate will be 4% in 2022.

An extended period of high inflation can play havoc with real value of your money. So, it’s crucial to ensure your investment strategy is geared towards mitigating the impact of inflation as far as possible.

Get in touch

If you want to talk through your own investment plans and find out how I can help you, please give me a call on 07769 156 250.

Please note

(Risk Warning: The Financial Conduct Authority does not regulate savings products)

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Pension income could also be affected by interest rates at the time benefits are taken.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation & Trust advice and Will writing.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.