A tale of 3 perceived threats to your future financial wellbeing

Whenever you’re putting plans together for a future event, it’s always prudent to think of the potential impediments that could prevent your plan coming to fruition.

Sometimes, however, it’s possible for you to overstate the danger of some threats, while at the same time underestimating the impact of potential problems that you should actually be more concerned about.

A recent report from the Center for Retirement Research at Boston College, which I read about on the CNBC website, highlights this problem with perception when it comes to planning your financial future.

The report correctly identifies three threats to your future financial health:

- Market volatility

- Rising inflation

- Increased longevity.

It then goes on to say that many people overestimate the effect investment volatility can have on their finances while, at the same time, underestimating how damaging high rates of inflation can be.

The effect of longevity – how long you’ll live for and so how long your money needs to last – is also very much underappreciated.

Stock markets rise as well as fall

It’s understandable why anyone with an investment portfolio fears a stock market crash.

They always make for dramatic headlines, with news stories about how billions have been wiped off the value of shares in a single day.

There will also probably be stock news footage of city traders in colourful jackets gesticulating wildly as they buy and sell – even though nearly all such trading is now done online.

In reality, however, the facts are far more prosaic.

The nature of markets means that they rise and fall. Individual companies have periods of sustained growth, followed by quieter times when the value of their shares can fall.

The same thing can happen in different market sectors and, at times, certain external events will affect many companies and sectors at the same time. For example, the outbreak of the Covid pandemic in March 2020 saw markets fall dramatically pretty much everywhere.

But, in a relatively short space of time, they recovered.

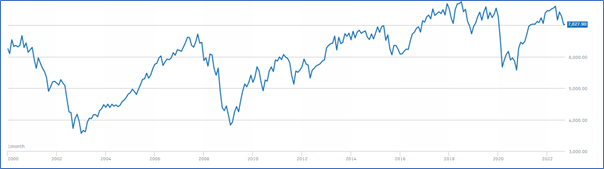

The chart below showing the performance of the FTSE 100 since the start of this century illustrates the point clearly. You can see several sudden falls, followed by a recovery.

Source: London Stock Exchange

There are two key things to remember when it comes to your investment strategy and facing the threat of a sudden market downturn:

- You’re investing for the long term, and markets will rise and fall over that period.

- A well-diversified portfolio can help guard against volatility in a particular sector or region.

High inflation is a bigger threat than a market crash

In reality, a period of high inflation is a far bigger threat to your future prosperity than a stock market crash – if you don’t plan for it.

The effect of high inflation is to dramatically reduce the purchasing power of your money.

For example, an inflation rate of 10% means that what cost you £100 a year ago will now cost you £110.

Unless we hit a period of negative inflation – which can create its own problems from an economic perspective – that increase is “baked-in” to your finances permanently.

That’s why the UK government has been so proscriptive in terms of setting inflation targets for the Bank of England to adhere to. It’s also why the recent high rates of inflation we’ve seen have been such a cause for concern.

You should remember that there are different rates of inflation across different goods and services. For example, the cost of gas and electricity is going up more than the current rate of inflation.

There are two key points to bear in mind when it comes to rising inflation and your financial planning:

- Greater returns on your investments can help offset the effect of rising prices.

- Look at your income and expenditure to see what adjustments you can make to help you ride out a period of high inflation.

Longevity is the great unknown

Advances in medical technology and improvements in the way we look after ourselves mean that life expectancy is rising.

When you retire it’s becoming increasingly likely that you’ll live longer than your parents and grandparents.

Figures from the Office for National Statistics show that a 67-year-old man has an average life expectancy of 85 years. For a woman the same age, the average life expectancy is 87.

These are average figures. But that means that there’s a 1 in 4 chance of the man living to age 92, and a similar chance of the woman living to age 94.

These type of life expectancy figures need to be taken seriously when you’re planning your financial future, especially when it comes to funding your retirement.

Clearly you don’t know how long you’ll live. Furthermore, uncertainty makes financial planning more difficult, but also more important: the less that’s left to chance, the better.

Two key points when it comes to longevity and planning your future are:

- Thinking carefully about your retirement costs, especially around issues such as later-life care

- Having a clear idea of how much you’ll need to fund your retirement plans.

You might find an article I wrote last year – “Who wants to live forever?” – useful when it comes to thinking about how long you’ll live and how you can plan for a comfortable retirement.

Get in touch

If you’d like to talk about your financial planning strategy, please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.