Why you should stop moving your goalposts

We are all, to some extent, driven to improve ourselves and our lives.

The instinct to earn more money and grow your wealth is perfectly understandable and praiseworthy. It’s a good thing we’re driven to improve our place in life.

But problems can arise when those instincts become all-consuming and you become overly focussed on the next acquisition, rather than being able to see the wider picture. In financial terms, that picture should be of your overall financial life plan, rather than a series of short-term purchases.

When success is simply defined as the next consumer purchase, it’s easy to become overly stressed and reach the position of never being entirely happy – regardless of your wealth.

The correlation between age and happiness

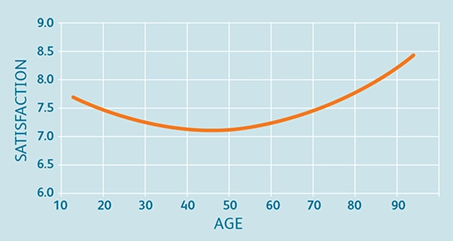

Research carried out by the Brookings Institute in the United States, used historical Gallup surveys to create this “Age and Life Satisfaction” chart:

It’s clear to see that you’re happy when you’re young, with the prospect of a fulfilling life ahead of you.

There is then a steady fall until your late 40s – a period when you’re most acquisitive, conscious of money, and looking to accumulate wealth.

From then, life satisfaction increases steadily up to and throughout your retirement years. These are the years when you’re most likely to be comfortable with what you’ve got – though it’s worth noting that it’s not until you’re in your mid-70’s that you’re as satisfied as you were as a teenager.

Financial drive is a positive thing

An element of reduced satisfaction is inevitable during the period from starting work to your 50s.

You’re motivated by career advancement and looking to become more comfortable. A key driver for that is to ensure that both you and your loved ones are safe and enjoying a good quality of life.

It’s also understandable that you want some of the trappings of your personal success, such as a better house, more expensive holidays, and luxuries like a new car every couple of years.

However, when the drive for more wealth becomes all-consuming, it’s easy to end up in a situation where it just leads to stress and dissatisfaction.

That’s the time when accumulating money and assets could simply create new problems rather than solve perceived ones. Is it being done for a purpose, or simply to fulfil an underlying need?

Creating a positive moment by spending money creates an endorphin rush of happiness, but it’s short-lived.

Often, it’s more about the anticipation than the actual acquisition itself. There’s a process of striving towards something, only to find that the happiness from acquiring it diminishes over time.

The mystery of your moving goalposts

Usually, the expression “moving the goalposts” refers to someone else moving them, and so making it more difficult for you to achieve your aims. However, in this instance, it’s more the case that, subconsciously, you’re moving them yourself.

If you’re not getting long-lasting happiness from achieving the things you set out to do, that may be because of your perception of what success means to you.

If success is defined as constant acquisition for acquisitions sake, you may never attain a feeling of fulfilled satisfaction.

This lack of fulfilment is often metaphorically described as the “hedonic treadmill.” In other words, the process of working towards something that gives you satisfaction, but then the feeling of contentment diminishing over time and needing to be replicated.

That’s why planning ahead, and having clear life goals, can be so important.

Robust plans can help keep you grounded and give you the reassurance that you’re on track.

Reiterating your core values

A key part of your planning process was outlined in the blog I shared with you on core values and what is important to you.

No two people are alike so, when it comes to defining your core values, there’s no “correct” answer. Likewise, your financial plan, which will be derived from those values, will be unique to you.

In the blog referred to above, I outlined that the best starting point for establishing your values was to consider your answers to four questions:

- What do you want out of life?

That may be difficult to clearly define at outset, but as time goes on and you move through your life journey it’ll become clearer. Once it’s stated, you’re in a position of strength.

- What is “enough”?

The answer to this will be both subjective and unique to you. Again, it may take time to come up with an accurate answer, and it’ll be underpinned by your attitude to wealth and your family.

- Do you feel you’re in control?

This will be partly down to how you manage your money and your wealth, but also about your attitude towards it.

- What will happen when you retire?

This answer will help define where you want to get to and how you’re going to get there. As with the other three questions, the answer might not be immediately apparent and is likely to evolve over time.

If you haven’t established your core values, you may be rudderless when it comes to wealth accumulation and planning for your financial future. And without that rudder it becomes increasingly likely that you’ll find that your financial goalposts are always moving.

Get in touch

If you’d like to talk about your financial planning strategy, please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.