What the story of the tortoise and the hare can teach you about investing

The unlikely inspiration for this article is a children’s story.

In Aesop’s legendary fable, The Tortoise and the Hare, the two animals race against each other. The hare sets off at top speed but is easily distracted, whereas the tortoise keeps up a slow and steady pace ignoring all the noise and distractions – ultimately winning the race.

It’s a parable I often have in mind when I’m thinking about investment strategies and how you should look to grow your wealth in the long term.

The attraction of new and shiny objects

When it comes to investment opportunities, it’s easy to believe the hype.

You’ll regularly read about new funds and shares in the media. They’ll be boosted by a large marketing spend, and the power that new and shiny objects can have to attract attention.

It’s long been the case that new ideas and concepts can attract speculators eager to get “in on the ground floor” when it comes to investing. That creates a snowball effect and, after a certain period, it’s inevitable that you’ll be asking yourself if you need to take the plunge.

But if you’re serious about growing your wealth, a long-term strategy is generally far more effective than jumping in and out of different funds simply because they’re attracting a lot of attention.

The power of persuasive salespeople

It can be hard to for you to avoid all the articles, social media posts and podcasts promoting new “get rich” schemes.

It’s easy to be persuaded by an experienced investment salesperson and attracted by the idea of short-term investment gratification.

But the feeling of being “in with the in-crowd” can soon be dispelled as the promised growth doesn’t materialise. In the worst instances you either find out it’s a dodgy investment in an obscure fund, or it’s actually a Ponzi scheme.

So, you end up deviating from your financial plan and losing sight of your ultimate goals.

The fear of missing out

One of the reasons you’re likely to be tempted by new investment opportunities is the fear of missing out (FOMO).

The hype we’ve already mentioned will include stories of people who timed their entry and exit from a particular opportunity correctly and ended up being successful.

But for every success story you read about, there will be far more failures – people who didn’t invest at the outset or didn’t time the market effectively.

Weighing up risk versus reward

Ultimately, successful financial planning can boil down to a battle between your head and your heart.

If you follow your heart, you’re more likely to be tempted by short-term opportunity.

For example, during one of the inevitable periods of market turmoil, you may well be tempted to try and recover your losses by changing strategy and tampering with your investment portfolio.

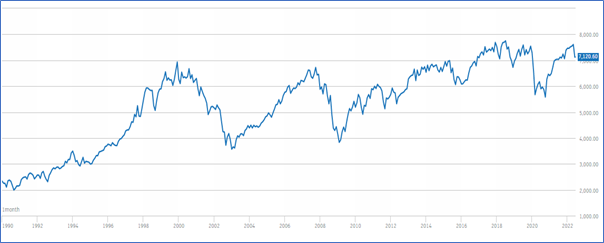

Take a look at this chart of one of the best-known markets – the FTSE 100 – since the start of 1990.

Source: London Stock Exchange

As you can see there are three noticeable downturns, where the temptation could well have been to tamper and chase your losses. Like the hare in Aesop’s story, you could have easily become distracted.

But if you’d held firm, continuing steadily like the tortoise, you’d likely have eventually recovered all your lost ground.

As well as that, if you’d stayed invested, and reinvested dividends throughout the period, Trustnet say you’d have enjoyed an annualised return of 8.6% a year.

When you’re putting together your investment portfolio, you should be thinking about the relationship between risk and reward. The higher the risk you take, the greater the opportunity for investment growth but, at the same time, the greater the chances of losing some – or even all – of your money.

Putting a winning team together

There are a series of different factors that can help you achieve your goals. None of them are particularly exciting, but, as you’ve already read, excitement and growing your wealth shouldn’t go together. And if you think they do, I would argue that you need better hobbies!

The factors you should be considering include:

The power of dividends

Dividends are an often-overlooked component of investment success. One key fact is that they are paid to you based on your shareholding, rather than share value.

So, even in a declining market, you can still get an investment boost. If you reinvest your dividends into the purchase of new shares, you’ll effectively get compounded growth-on-growth.

Time

There are rarely shortcuts when it comes to a successful investment strategy. The longer your investment time frame, the less the chances of short-term market upheaval affecting your long-term investment targets.

Investment advice

A landmark research study carried out by leading investment fund managers, Vanguard Asset Management, quantified the value of financial advice (“adviser alpha”) at 3% net a year.

The study is pertinent to what you’ve read here in that more value is added through managing client behaviour than actual investment choice.

Simplicity

The simple can often be boring, but a boring strategy will also be more likely to lead to you achieving your financial goals.

You should always look to be the tortoise rather than the hare.

Get in touch

If you want to talk about your investment strategy, please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation & Trust advice and Will writing.