We need to talk about inflation

You’ve probably noticed that the spectre of rising inflation is dominating the economic headlines at the moment.

Almost every news programme you watch or newspaper or website you read will reference it, and the associated cost of living crisis.

The rate of inflation reached 9% last month – the highest rate for more than 40 years. The latest Bank of England report suggests it’ll reach double figures later this year.

Given how impactful high inflation can be on your day-to-day life, as well as your long-term financial planning, I thought it was worth devoting an article to it.

We aren’t used to high inflation

In very simple terms, inflation is the rate prices have risen in the last 12 months. So, a current inflation rate of 9% means that goods and services that cost you £100 to buy twelve months ago will now cost you £109.

Obviously, there are variations on this theme. Prices aren’t rising uniformly, but overall, the price you’re paying for goods and services is rising. An iNews report suggests the price of fresh beef is up by more than 11% year-on-year, while the average price of dog food has risen by almost 17%!

One reason why high inflation is so noteworthy, and newsworthy, is that we’re so used to it being low.

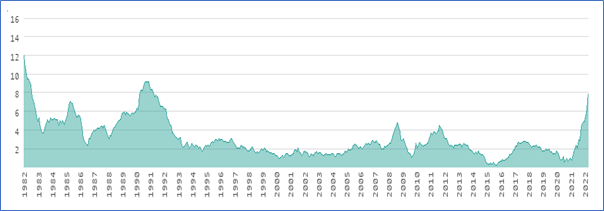

Look at the chart below showing the UK rate of inflation over the last forty years.

Source: worlddata

The spike on the far right shows the dramatic rise in inflation since the start of 2021. Looking back over the years, you can see that – apart from a couple of small peaks in 2008 and 2011 – we’ve enjoyed an unprecedented period of low inflation.

It’s remarkable to think that, if you’re under 50, you won’t have experienced inflation above 5.5% in your working life. We’re now heading to a rate close to double that.

A perfect storm

An unprecedented series of events has created a perfect storm that has driven inflation up.

The opening up of economies created a surge in pent-up demand after the months of lockdown, but suppliers were unable to meet that demand as they struggled to rebuild supply chains that had been affected by the pandemic.

At the same time, supply chains were further disrupted in the aftermath of the United Kingdom leaving the EU. The sudden withdrawal from the EU free trade area and removal of freedom of movement meant businesses reliant on importing and exporting goods, and an inflow of labour form eastern Europe, have suffered.

A third factor is clearly the Russian invasion of Ukraine that has sent energy prices and the cost of petrol soaring.

In each case, you’re going back to basic economic theory about supply and demand. If demand outstrips supply for any reason, then prices go up. Supply chain issues, and a war on the European mainland, are restricting supply.

Inflation means the value of your wealth is eroding

Continuing rising prices means the purchasing power of your money reduces year-on-year.

Even just a couple of years ago, if you’d read an article citing the potential impact of inflation at 10%, you’d have considered it hyperbolic – even scaremongering.

As you saw from the chart earlier in this article, we’ve become so used to low inflation, it’s baked-in to all the assumptions that drive your finances.

But now it’s fair to say that two years of inflation at 10% would mean that what costs you £100 to purchase now will cost you £121 in 2024.

That assumes your salary remains unchanged which, of course, is unlikely. But it does demonstrate how a long period of inflation can affect your finances.

It’s uncertain how long high inflation will be with us

Government and central bank powers to reduce inflation are limited. The accepted method is to increase interest rates to encourage saving and therefore reduce the amount being spent on goods. Higher interest rates are designed to encourage saving and reduce demand.

The Bank of England have already shown that they are prepared to do this and it’s easy to imagine further rises if the economic indicators don’t start pointing to a fall in inflation in the coming months.

The best panacea is strong economic growth, and the government will be doing all they can to help drive this.

It’s likely that at least some of the post-Covid supply chain issues will sort themselves out, but there’s no sign yet of an end to the war in Ukraine, so high fuel and energy prices could be with us for some time yet.

The impact on your finances

Obviously, once you’ve waded through the economic lessons, your chief concern will be how will high inflation affect your financial planning.

From an overarching perspective, the worst thing you can do is to panic. If you have a robust plan in place you should stick to it. Making sudden changes to your investment strategy, for example, is more likely to blow your future plans off course than solve any current problems.

There are, however, some things you can do to mitigate the effect of high inflation and help keep your finances in shape and stay on track.

These include:

- Carefully manage your discretionary spending to help offset the reduced purchasing power of your money.

- Consider adjusting or rescheduling your short-term future spending plans. Maybe trade-in your car in two years time rather than next year or consider postponing the big holiday you have planned.

- As your income goes up, make sure the amount you pay into your pension also increases. If you’re in an employer-run scheme that should happen automatically, but if you have your own arrangement, be sure to top it up.

- Consider taking on more investment risk to increase your potential for growth. This will clearly be dependent on other factors, such as your capacity for investment loss and investment time frame.

- If you’re approaching retirement, you may need to review your initial income strategy.

With regard to the last two items on that list, I’d strongly recommend you seek expert advice before proceeding.

Get in touch

If you want to talk about any of the issues you’ve read about in this article, please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation & Trust advice and Will writing.