5 practical things you need to know about estate planning for your parents

In one of my blog articles last month I looked at the issue of financial planning for your parents, and how you can help them manage their finances.

In that article I referenced estate planning, and how effective planning can help protect both their assets and you.

Given the breadth of the subject, I promised that I’d devote an entire article to it. So, here are the key things you need to know about estate planning for your parents.

The importance of effective estate planning

It’s certainly well worth the time and effort in ensuring your parent’s wealth is managed effectively, particularly from an estate planning perspective.

In 2019/20, more than £5.2 billion was paid in Inheritance Tax (IHT). Although this impacted on fewer than 5% of estates, the continuing increase in the value of property and long-term investment growth means that more people could be subject to IHT in years to come, with more families receiving an unwelcome tax bill on the death of loved ones.

Planning in advance can help more wealth pass between the generations, while ensuring that your parents continue to enjoy a comfortable lifestyle.

Introducing the subject of estate planning

Failure to plan for what happens to someone’s wealth when they pass on can create long-lasting and potentially serious problems for their remaining family.

At the same time, conversations about both money and death can be uncomfortable, and equally emotional, for all those concerned.

As you’d have seen in my article last month, however, you could well find that it’s an issue that your parents have been thinking, and worrying, about. They may therefore be relieved when you make it clear that you’d like to have a conversation about it.

There’s no “one size fits all” solution when it comes to you kicking off the conversation. You will know your parents better than anyone, so only you will know the best way to introduce the subject.

Three things you might want to consider are:

- Keeping the focus on fulfilling your parents’ wishes rather than talking about the tax you may have to pay on their death

- Couching the conversation in terms of avoiding dispute between yourself and your fellow siblings (if applicable) and other family members

- Ensuring that your siblings and other family members are either part of the conversation or are kept abreast of your discussions and plans.

Make sure you understand how IHT works

A key first step is to ensure that both you, and your parents, understand how IHT works.

A common misconception is that IHT is paid on the entire value of the estate of the deceased. In reality, the “nil-rate band” means the IHT is only payable on a proportion, rather than the whole value.

So, you will pay IHT at a rate of 40% on the value of your parents’ estate above the applicable nil-rate band. The current nil-rate band is £325,000 per individual – frozen at that amount until 2026.

On top of that, each person has the potential of a residence nil-rate band, which is currently £175,000.

Any unused percentage of nil-rate band and residence nil-rate band can both pass to the surviving spouse or civil partner on death.

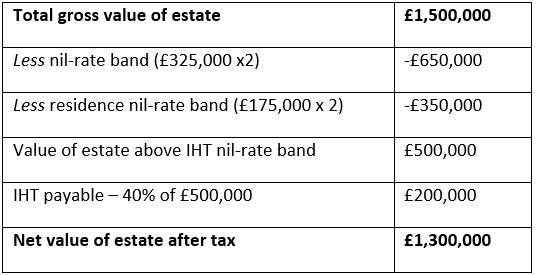

In this example, the surviving spouse has died, leaving an estate worth £1,500,000 gross, including a property worth £400,000.

In the 7 years before she died the surviving spouse had not made any potentially exempt or chargeable lifetime transfers and there is also both a 100% transferable normal nil rate band and residence nil rate band available, the effect of which is to double her available nil rate bands from £500,000 to £1 million.

As you can see, both nil-rate bands and nil-rate residence bands have been used, which reduce the IHT liability by £400,000.

Five ways you can reduce the potential IHT burden

Here are five ways you can plan your parents’ finances to help reduce your potential IHT liability.

1. Wills

First, and probably the most important, is to make sure both your parents have a will in place. In a survey carried out by a consortium of charities in September 2019, it was revealed that nearly two thirds of people don’t have a will and therefore risk dying intestate.

Having a valid and up-to-date will ensures that their assets are disbursed according to their wishes, and the disbursement is carried out by their choice of individual.

A will underpins all the other IHT planning.

2. Gifting assets

Gifting assets is an effective way of reducing a potential IHT burden. The “seven-year rule” means that beneficiaries will not pay IHT on the value of the gift if the person making the gift lives for seven years after the date of making the gift.

Additionally, there are various exemptions that your parents could make use of. For example, everyone can gift £3,000 each year and this amount will immediately fall outside the value of their estate. They can also make exempt gifts for weddings or civil ceremonies.

3. Setting up trusts

Trusts can be an effective way to distribute wealth to relatives and help reduce the value of an estate that will be liable for IHT.

A trust is a legal document where property or other assets pass to a trustee, who then manages the assets on behalf of the ultimate beneficiary.

There is a wide choice of trusts available and it’s therefore possible for your parents to leave a legacy to you or your children.

4. Managing property

It’s likely that your parents’ residential property will be their biggest asset. The rise in average property values means that it’s also possible that the value will exceed their combined residence nil-rate band (£175,000 each) and therefore potentially be liable for IHT.

It’s possible to remove their residential property out of the value of their estate by passing it to you, while continuing to live in it while paying a market rent.

While a potentially attractive solution, this can be complicated, and mistakes can prove costly. You should consult an experienced financial adviser to support you with this.

5. Income planning

Managing how your parents take their income from pensions and savings can also help reduce the value of their estate that will be liable for IHT.

Pension value is generally exempt from IHT. Many people take advantage of this, ensuring that much of the value of their pension passes down to future generations.

From an IHT perspective, therefore, it can make sense to draw income from other savings such as ISAs, and investments in stocks and shares – all of which will normally form part of an estate for IHT purposes.

There’s no time like the present

You’re looking for a robust plan that allows wealth to be passed between generations in a way that fulfils everyone’s needs and wishes.

Given the complexity of some of the issues and suggestions raised here, the sooner you can start putting plans together, the better chance you have of a successful plan.

Get in touch

To find out more about estate planning for your parents, please give me a call on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate taxation & Trust advice and Will writing.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.