10 golden rules for investing in 2021

When it comes to investing, there are no shortcuts or magic wands you can wave to generate great returns. Indeed, only recently I looked at why following trends and jumping on the bandwagon can backfire spectacularly.

Sensible investing is more about sticking to tried-and-tested strategies. Here are 10 golden rules for investing in 2021.

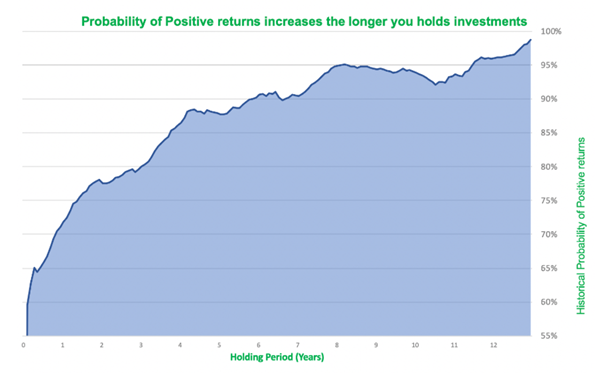

1. The longer you hold investments, the greater the chances of success

Research from Nutmeg has found that, if you had randomly picked one day between January 1971 and May 2020 and chosen to invest in the market for just that day, you would have had a 52.3% chance of making gains. It’s about the same as the toss of a coin.

Staying invested for the long term significantly increases your chance of generating a positive return.

If you had invested your money for three months (65 days) during that same 49-year period, your chances of making a profit increased to 65.1%. If you had invested for a year, you would have generated a positive return 71.8% of the time. Investing for ten years increased your chances to 94.0%.

Interestingly, if you had invested in the stock market for more than 13 and a half years at any point during this period, you would never have lost money.

Source: Nutmeg

2. Every time is different

Before 2020, the shortest bear market in US history was in 1987, where the S&P 500 declined by 36% in just under two months.

So, when markets fell sharply over a month in February and March 2020 as the pandemic hit, it was reasonable to assume that the downside would continue. Indeed, with the world in lockdown many experts were predicting a crash on the scale of the Great Depression.

However, the US stock market rallied on March 24 and then never looked back. It became the shortest bear market in history, lasting just 33 days. The market was back at an all-time high five months later.

3. Forecasts are a waste of time

Earlier this year I wrote about why listening to forecasts and predictions is a waste of time.

In January 2020, who predicted the UK’s worst economic performance in 300 years? In March 2020, who would have predicted stock markets would hit record highs in the same year?

No one can foresee future events, or the markets’ reaction to them. UK house prices are a great example – they hit a new record high in December 2020 despite a year of restrictions and lockdowns. Not even the best experts predicted that!

4. You can’t buy time

My aim as a financial planner is to help you to live the life you want with the money you have.

Financial expert Charlie Bilello says: “Prudent asset allocation is the foundation of a successful long-term investment plan while prudent time allocation is foundation of a successful long-term life plan.”

Don’t get too bogged down in your investments or earnings and forget about spending your time wisely. No one ever said on their death bed, “I wish I’d have spent more time at work’”

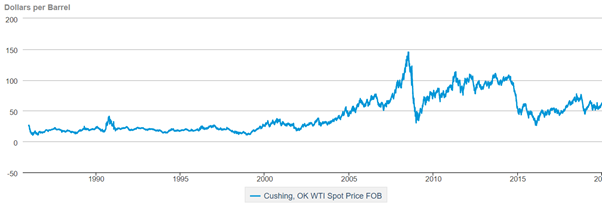

5. The only certainty is change

While it can be instructive to look at historical evidence when it comes to investing, it can’t predict the unexpected.

You only have to look at what has happened in the last 12 months for evidence. There’s a reason that common risk warnings say: “Past performance is not a reliable indicator of future performance”!

Here’s an example. This is the spot price of a barrel of crude oil, from the late 1980s until the end of 2019. There have been peaks and troughs, but it has spent much of that period at between $25 and $100 a barrel.

Source: US Energy Information Administration

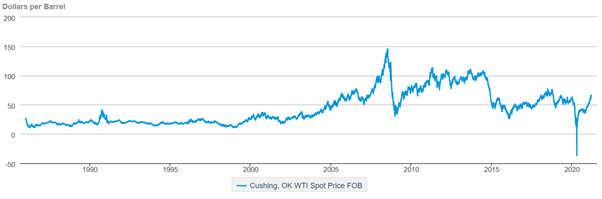

Let’s extend that chart to include 2020.

Source: US Energy Information Administration

Yes, in 2020, prices went negative for the first time. Demand had collapsed, supply was high, and traders were paying people to take delivery of their oil as there was nowhere to store it.

Using all normal statistical predictions, this should never have happened. But it did. And strange things like this will happen in other markets, at other times.

6. Saving is more important than investing

While you may be fixated about how your investments are performing, how much you save is more important.

Over 30 years, saving 8% of your income with a 1% rate of return easily beats saving 1% of your income with an 8% return.

Using the UK’s median income of £29,900:

- Saving 8% each year, over 30 years, with a 1% growth rate means a fund of £87,220

- Saving 1% each year, over 30 years, with an 8% growth rate means a fund of £39,062.

Source: TheCalculatorSite

(Note: this doesn’t take inflation, taxes or charges into account).

Staying in control of how much you save, and sticking to your plan, is more important to your success than the return you achieve.

7. Reap the benefits of compound growth

Albert Einstein called compound interest the “eighth wonder of the world”.

Returns on returns can provide much of your growth, so it’s important that you stick around long enough to take advantage of these benefits.

We call it “time in the markets”. Rather than trying to buy low and sell high, a good strategy involves remaining invested for the long term. It also means avoiding emotional and knee-jerk reactions to market movements that could damage your long-term plans (more of this in a moment).

8. Don’t put all your eggs in one basket

It’s impossible to predict which asset class is going to perform most strongly. Will it be UK equities? Global equities? Cash? Property? Gilts?

This table ranks the annual performance (to end April) of various asset classes between 2010 and 2019.

Source: Royal London

You’ll see that some asset classes perform better in some years than others. This is why it’s so important to diversity your holdings, across asset classes and countries. If one area isn’t performing so well, another will be and can balance this out.

It’s one of the reasons that many investors saw a positive return in 2020, despite a 14.3% fall in the FTSE 100 in 2020. Diversified investors benefited from strong growth in assets such as US and emerging market equities.

9. Control your emotions

Emotions affect our decisions. So, keeping those emotions in check can help you to avoid making decisions based on fear or greed.

My guide to behavioural biases is a great place to start if you want to understand the impact of your behaviour on your financial plans.

10. Take professional advice

Financial advice adds value in two vital ways:

- It can help you to boost your wealth. A 2019 study by the International Longevity Centre found that people who took financial advice in 2001 to 2006 saw a £47,706 boost to their wealth in 2014/16.

- A 2020 study by Royal London found that people who worked with a financial planner were more confident, felt more in control, and benefited from more peace of mind than people who did not take advice.

To find out more about how I can help you to create a robust financial plan that can help you achieve your goals, please give me a call on 07769 156 250.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.