GameStop, Bitcoin and Reddit – how to avoid “get poor quick” schemes

In the decade after the Liverpool and Manchester Railway opened nearly two centuries ago, it became a huge commercial success.

Of course, Victorian entrepreneurs noticed this. A newly affluent middle class wanted to invest and, with interest rates (and gilt prices) low, they saw an opportunity to profit from the railway boom. In 1843 there were 63 applications to parliament for new railways. In 1844 there were 199; in 1845, 562.

When it became clear that not every railway was commercially viable – indeed, many were not – stock prices in railway firms fell sharply. As the railway bubble collapsed, many investors were left empty-handed.

Watching the recent shenanigans and news coverage of the US retailer GameStop, and cryptocurrency Bitcoin, brings the Victorian railway bubble to mind. What seems like a “get rich quick” scheme can often sour quickly, leaving investors red-faced and out of pocket. Following the trends isn’t always the path to riches; indeed, it’s often quite the opposite.

GameStop – a cautionary tale

For many younger people, social media is the go-to place for news, entertainment, and advice. In the last few weeks, influencers have flooded channels such as Reddit, Twitter, and TikTok with investment advice.

The most newsworthy of these was the US retailer GameStop.

Historically, investors have heavily “shorted” GameStop stock – essentially betting the stock price will fall. Recently, a group of investors who came together through Reddit began promoting GameStop stock. They took on huge hedge funds, who had shorted GameStop stock, forcing the funds to close their positions and lose billions of dollars.

Of course, the more people invested in this stock, the higher its price climbed.

The issue with GameStop is that its suddenly inflated stock price didn’t match the company’s overall financial situation. In fact, the retailer was struggling and had plans to close 1,000 stores by the end of its financial year.

So, the stock price had been artificially inflated so that a relatively small group of investors could make large sums of money. For the average investor looking to buy and hold an investment for the long term, the rocketing stock price should have been a warning sign.

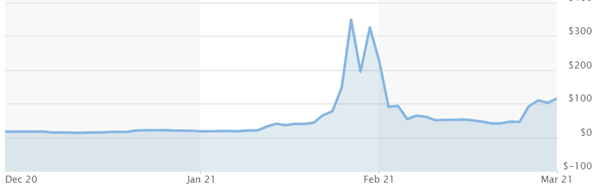

Here’s the GameStop stock price over the last three months:

Source: MarketWatch

While a few investors were lucky, many jumped on the bandwagon and bought at highly inflated prices – $300 per share or more – and saw the value of their holding plummet.

Be wary of social media investment advice

Recently, there has been a lot of focus on how social media influencers are providing – how shall I put it? – “less than adequate” investment advice.

According to MarketWatch, the #investing hashtag on TikTok had about 1.6 billion views, and GameStop was searched about 600 million times in a single day on the app.

The BBC also found several popular video-makers on TikTok encouraging people to buy shares in GameStop, BlackBerry and AMC.

The cryptocurrency trading platform, Paxful, studied 1,200 TikTok videos and found that about one in seven videos about financial investments were misleading and asked users to make financial decisions without carrying disclaimers.

Much of the offending content advised followers to buy specific assets such as individual shares, rather than a broader asset class or genre. They were also often guilty of implying guaranteed profit or suggesting a specific number of shares to buy.

Financial psychologist Dr Brad Klontz says: “TikTok is the fastest-growing social media platform. Like it or not, people are getting information on personal finance and investing there.

“These platforms can be helpful for education, but the content should never be used as advice. There’s no one approach to investing that is best for everyone, so general advice is rarely appropriate.”

The Financial Conduct Authority has also warned investors to be cautious. A spokesperson told the BBC: “Consumers should be wary of adverts and advice online and on social media promising high-return investments and should always do further research on the product they are considering.”

No substitute for a long-term plan

There will be some investors who have profited from GameStop, Bitcoin, or other trending bubbles.

However, as I wrote about recently, focusing on your own long-term goals, and having a disciplined plan in place, is always going to be better (and less stressful) in the end.

Getting advice from Reddit and ploughing your money into a single stock ignores many of the rules of sound investment. You’re not diversifying your assets. You’ve done no research or due diligence on the company. And you’re ignoring a key issue: what you are investing for.

Buying GameStop stock isn’t investing; it’s gambling. And you don’t need me to tell you that the house always wins.

Get in touch

To find out more about how I can help you to create a robust financial plan that can help you achieve your goals, please give me a call on 07769 156 250.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.