Why great investors have optimism in the future

Last month, we looked at five reasons to be optimistic in 2021 and how optimism can drive positive change.

With the new year on the horizon, it’s easy to be pessimistic about how the economy might fare next year. Indeed, the Chancellor himself has warned that unemployment will reach 7.5% in the middle of 2021, and that GDP is not expected to return to pre-crisis levels until the fourth quarter of 2022.

Choosing to be pessimistic about your savings and investments, and keeping them in a ‘safe’ place, can be reassuring during difficult times. Many psychological biases come into play, most notably the theory of ‘loss aversion’ which states that humans feel the pain of losses twice as powerfully as we feel the pleasure of gains.

Despite this, I think there are compelling reasons to remain optimistic as we head into 2021. Here’s why.

Investing in human progress

Why do we invest our money?

In simple terms, it’s because we expect our money to grow. We are essentially deferring the gratification of spending it now until some point in the future where we hope we’ll get even more value from it.

It, therefore, follows that we need to be optimistic about the future, otherwise why would we expect to get a return somewhere down the line?

It’s better to think of investing not as a question of if your money will grow, but when your money will grow.

Matt Ridley’s book The Rational Optimist makes this point elegantly. Essentially, Ridley argues that it is perfectly rational to be optimistic about stock markets because it is a position that respects decades of economic history.

An optimist isn’t just hoping things will be okay in the future. They are putting their faith in the future, safe in the knowledge that there is (and has always been) an economic trend of progress.

Humans are ingenious creatures, and throughout history, we have strived to better our way of life. Think about the amazing progress humanity has made in just the last 10,000 years. Or even the last 100 years!

When we invest, we are essentially investing in human ingenuity. It is an infinite resource that improves our quality of life, tackles huge human problems (the Covid-19 vaccine is a great example), and drives progress. Consider medicine, technology, economy – the advance is permanent. Declines are temporary.

Of course, terrible things happen. Turn on the news on any given day and you’ll see pictures of poverty, war, floods, and famine. However, as I shared last month, the world is constantly becoming a better place. It’s the most peaceful time in our species’ existence. Renewable energy is the fastest-growing energy source globally. Global health is improving year-on-year.

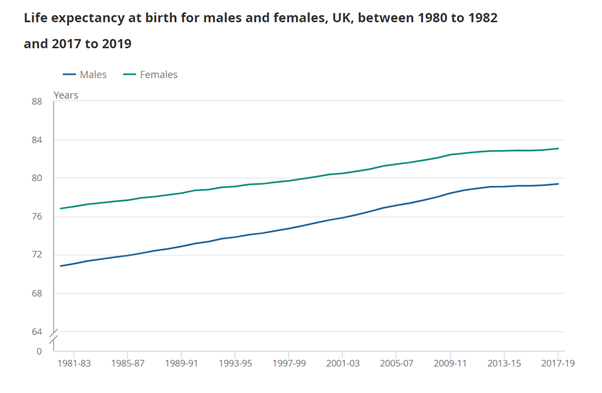

Even in the last 40 or so years there has been huge progress. As the chart below shows, even since 1981, the life expectancy of a woman has risen by just over six years. For a man, it has risen by eight and a half years.

Source: Office for National Statistics

Time in the markets, not timing the markets

Having faith in the future and becoming an optimistic investor means that you must be prepared for volatility.

Again, based on historical trends, the world faces instability roughly every ten years. If we filter this down to a national level – think Brexit, for example – it’s reasonable to expect uncertainty every few years. From a pandemic to political instability, uncertainty can happen at any time.

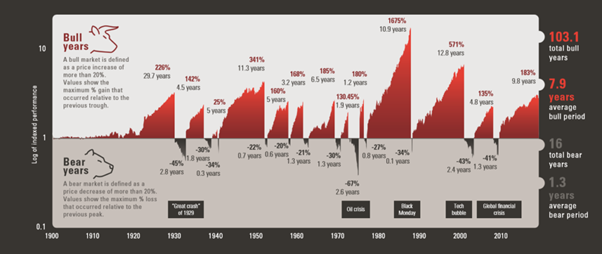

However, when it comes to investing, setbacks are often only temporary. Earlier this year, I looked at how ‘bear markets’ (when the value of investments fall by more than 20%) are typically much shorter than bear markets (where the value of investments rise by more than 20%).

Even during periods of significant volatility (the Great Depression, Black Monday, the global financial crisis), bear markets have been followed by strong periods of growth.

Notes: Calculations are based on FTSE All Share (GBP Total Return). A bear market is defined as a price decrease of more than 20%. A bull market is defined as a price increase of more than 20%. The plotted areas depict the losses/gains ranging from the minimum following a 20% loss to the respective maximum following a 20% appreciation in the underlying index. Time period: The date range on this graph covers 1900 to 2018. As we are currently in a ‘bear market’ within the investment cycle, it is not possible to show up to date values until we exit this bear market. The graph is being used to demonstrate complete bull and bear markets over the last 118 years. Calculations based on monthly data. Logarithmic scale on y axis. Source: Global Financial Data.

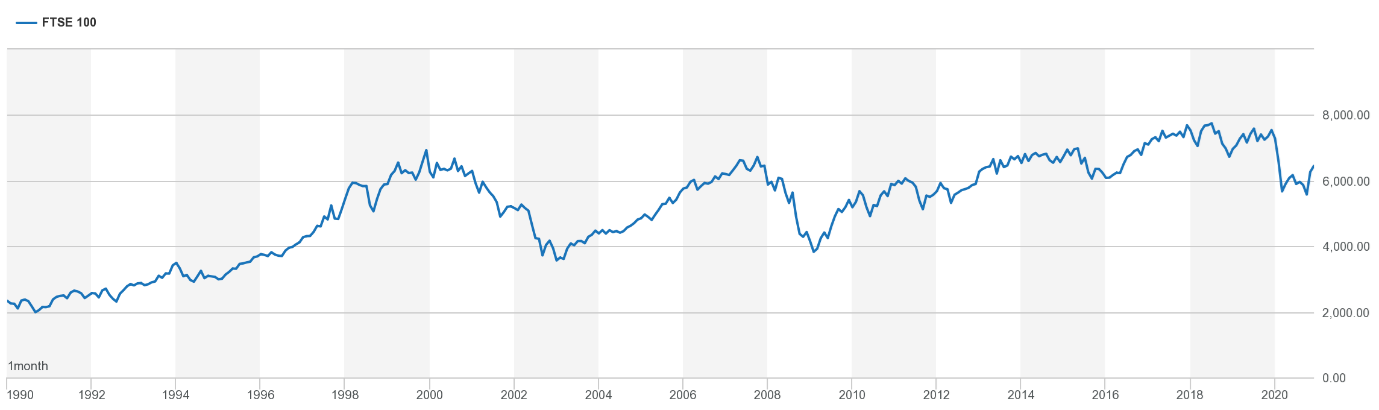

Here’s a more recent example. The chart below shows the performance of the FTSE 100 index between 1990 and 2020. Over this 30-year period the value of the index has trebled, meaning the optimistic, patient investor who put their faith in the future was handsomely rewarded – despite blips including the dotcom bubble, the global financial crisis, and the EU referendum.

Source: London Stock Exchange

The conclusion is simple. Over time, stock markets do fluctuate and there will be times when indexes show a significant fall. However, in time, the markets have typically recovered, and any subsequent gains have generally outweighed losses.

It’s all but impossible to predict when to sell at the peak and buy at the bottom of the market. If you’d patted yourself on the back for selling your Dow Jones tracker on 21 February 2020, just before the fall, you’d have kicked yourself on 24 November 2020 when it hit a record high.

If we reverse the standard call to arms for a moment, “Don’t just do something. Stand there!”

Good, optimistic investing comes from enduring difficult periods in order to enjoy long-term returns, knowing that the effect of compounding over years of accrued interest during prosperous periods will drive positive growth.

As the great investor Warren Buffett says: “The stock market is a device for transferring money from the impatient to the patient.”

Get in touch

The more you give in to chasing gains, and trying to time the market, the more mistakes you’re likely to make. It’s important to stay focused on your long-term goals and to believe in the power of history and the markets.

If you’d like to find out how I can help you to ‘keep the faith’, please give me a call on 07769 156 250.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.