Everything you should know about keeping calm during uncertain periods

It’s certainly been quite the few weeks! Whether you have been working from home, acting as a stand-in teacher, or even struggling with the virus yourself, it’s certainly been a period none of us are ever going to forget.

On top of health and economic concerns, turmoil in global stock markets may also have led you to worry about your future. Do I need to make changes to my portfolio? Are my investments going to be enough? Can I still retire when I plan to?

It’s fair to say that times are stressful enough without having to worry about your money as well.

One simple solution is: don’t.

Of course, it’s not that simple. However, to help you, here is some clear evidence of why keeping calm and retaining a long-term perspective can really work.

Bulls and bears

In recent months you have probably seen reference to both ‘bull’ and ‘bear’ markets. That’s because the longest bull run in American history has swiftly been followed by a coronavirus-fuelled bear market.

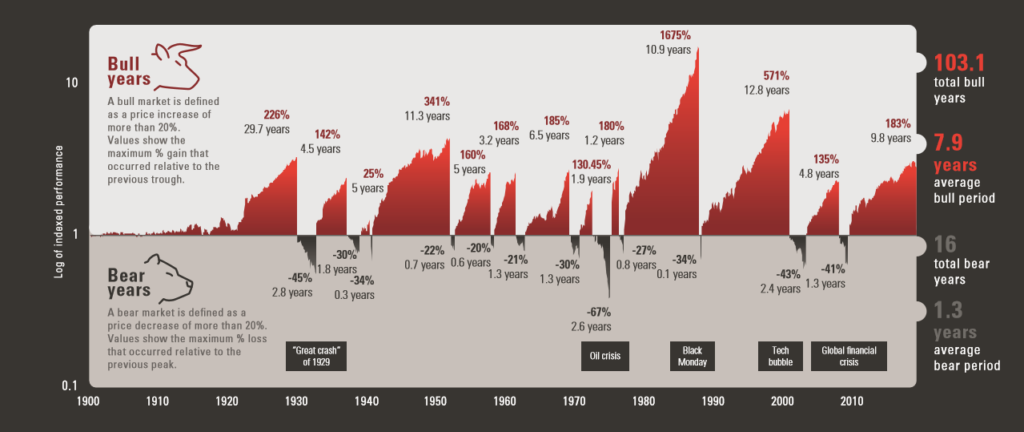

- Bull markets occur when the price of an investment rises over an extended period – typically a rise of 20% or more. Significant bull markets include the period immediately after the Second World War, and the mid-1980s run that ended on Black Monday. On August 22, 2018, the bull market became the longest-running in US history.

- Bear markets occur when the price of an investment falls at least 20% or more from its 52-week high; for example, a 20% fall in the FTSE 100 index. A bear market is typically caused by a loss of investor, business, and consumer confidence, which is often triggered by a stock market crash, when share prices fall by around 10% in a day or two. This is exactly what happened in March, when both the Dow Jones and FTSE 100 saw their biggest daily fall since 1987.

You may be concerned about the bear market we now find ourselves in. However, the evidence shows that bear markets tend to be relatively short and are subsequently outweighed by strong bull markets.

This chart shows the bull and bear markets in the UK since 1900. What is notable is that the average period of stock market rise is almost eight years, while the average bear market lasts less than a year and a half. Even during periods of significant volatility (the Great Depression, Black Monday, the global financial crisis), bear markets have been followed by strong periods of growth.

Notes: Calculations are based on FTSE All Share (GBP Total Return). A bear market is defined as a price decrease of more than 20%. A bull market is defined as a price increase of more than 20%. The plotted areas depict the losses/gains ranging from the minimum following a 20% loss to the respective maximum following a 20% appreciation in the underlying index. Time period: The date range on this graph covers 1900 to 2018. As we are currently in a ‘bear market’ within the investment cycle, it is not possible to show up to date values until we exit this bear market. The graph is being used to demonstrate complete bull and bear markets over the last 118 years. Calculations based on monthly data. Logarithmic scale on y axis. Source: Global Financial Data.

The conclusion is simple. Over time, stock markets do fluctuate and there are times when indexes show a significant fall. However, in time, the markets have typically recovered, and any subsequent gains have generally outweighed losses.

Take the global financial crisis as a recent example. The data shows that markets fell by 41% over a period of around 16 months. However, in the subsequent 129 months, markets rose by 212%. If you had pulled your money out of equities during the 2008/09 bear market and never returned, you would have missed out on these gains.

Don’t measure your asset values from the top of the market to now

When considering how your portfolio has performed over time, it’s important to look over the long term. Even now, the FTSE 100 sits at a higher level than it did in February 2016.

Source: London Stock Exchange

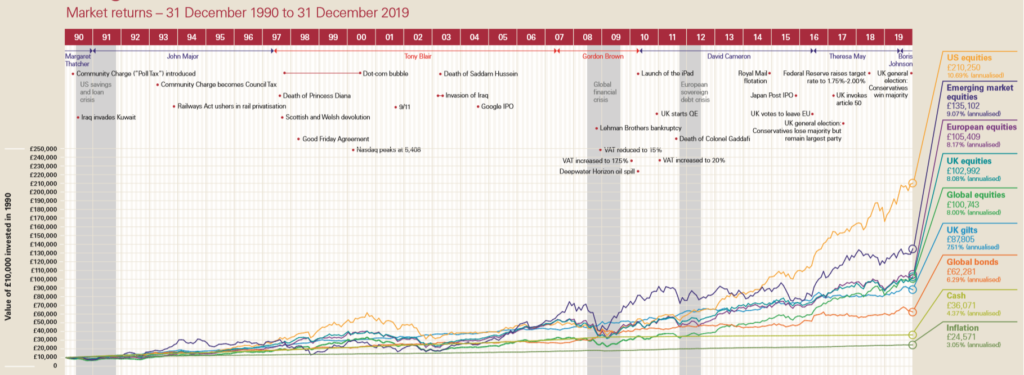

Over the past 25-30 years, investors have achieved good returns across a range of asset classes. This chart shows how much £10,000 invested in a range of assets on 31 December 1990 was worth on 31 December 2019.

You’ll see that £10,000 invested in UK equities at the end of 1990 was worth £102,992 at the end of 2019.

Notes: Cash = ICE LIBOR – GBP 3 month; global equities = the MSCI World Index; US equities = S&P 500; UK equities = FTSE All-Share; inflation = Retail Price Index, (Jan 1987=100); global bonds = Bloomberg Barclays Global Aggregate; European equities = MSCI Europe; UK gilts = ICE BofA; UK gilt (local total return) emerging market equities = MSCI emerging markets; all shown gross of taxes and of fees and in GBP. Source: Bloomberg and Factset and Bank of England, as at 31 December 2019.

If markets have fallen, remember that you still own everything that you did before. You still have the same number of shares in the same businesses, and the same bond holdings. And, you’ll only turn a paper loss into an actual loss if you sell at the wrong time. In the long term, as the charts show, markets typically recover.

Headline market falls are rarely mirrored in your portfolio

The unpredictability of markets is what is designed to give you good long-term returns. It’s also worth remembering, though, that your financial planner has designed your portfolio to deal with exactly the sort of uncertainty we’re currently seeing.

The likelihood is that you will have defensive assets in your portfolio, including bonds and cash. This means that headline falls in the FTSE and other indices reported on the news are not generally reflected in the value of your own portfolio.

The balance between growth and defensive assets was carefully established by your financial planner to ensure you can withstand temporary falls in the value of your portfolio, both emotionally and financially.

Going forward, your planner can rebalance your portfolio to make sure that you have the right level of equities to benefit from future rises in markets.

If you want to have a chat about your financial plan or you’d like advice on meeting your goals, please give me a call on 07769 156 250.

The value of your investment can go down as well as up and you may not get back the full amount invested. Potential investors should be aware that past performance is not an indication of future performance.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.