The 5 levers that control your financial independence

When the government revised their action plan to tackle the coronavirus crisis, one of the new slogans Boris Johnson unveiled was ‘control the virus’. This message came in for some criticism, with many questioning just exactly how an individual was supposed to ‘control’ an invisible, global disease.

When I first heard the new slogan, it got me thinking about what it is in life we can actually control. When planning for your own financial future there are a range of factors that sit well within your control, and steps you can take to ensure your financial independence.

So, if I may paraphrase the government’s advice for a moment, here are five ways you can ‘stay alert, control your finances, and save your retirement’.

1. Spend less than you earn

If there is one simple rule that you followed at the expense of all others, this is it. While I appreciate it sounds obvious, sticking to a budget and spending less than you earn can be harder than it first appears.

You’re never going to be financially independent if you spend more than you have coming in every month. You’ll end up in debt (see below) and have to deal with the stress that comes with managing this.

If you spend less than you earn, and you save the difference (even if it’s only a small amount) each month, you are becoming better off. With every pound you save you take a little more control and a further step towards your own financial independence.

2. Eliminate bad debt

Sometimes, taking on debt can be good for our financial future. For example, taking on a mortgage should leave you better off in the long term and should not have a negative impact on your overall financial position.

However, there are plenty of ‘bad debts’ out there – and these are the ones you should avoid or try and eliminate.

According to 2019 figures from financial analysts Moneyfacts, the average APR of a credit card in the UK sits at 24.7% – its highest point since Moneyfacts started to maintain records in 2006.

At the same time, the underlying purchase rate (which does not include a card fee) is also at an all-time high of 22.53%.

It’s a simple calculation. If you have £1,000 on a credit card where you’re paying interest at 24.7%, and £1,000 sitting in a savings account where you’re earning 0.5%, you’re losing out.

So, one of your first steps should be to repay as much of your ‘bad debt’ as possible.

3. Invest slightly more than you are comfortable with

Historically, risk tends to lead to greater returns. We recently looked at the long-term performance of stock markets to consider that, even though markets can be volatile, they tend towards positive returns in the long term.

Of course, stock markets can be a bumpy ride. So why would you want to invest more than you are comfortable with?

The answer is: because it can help you to reach your goals.

A well-diversified portfolio goes a long way to mitigating risk. It also helps to smooth out the turmoil in the markets. Working with a financial planner can help you to balance risk and return, and to manage your portfolio in a way that enables you to achieve your financial goals.

4. Stay invested

On March 12th, the FTSE 100 and Dow Jones both experienced their worst single one-day fall since 1987. So, how many investors exited the market on March 11th? The answer: precious few.

Those that did perfectly time the fall were probably still patting themselves on the back in the week before Easter, when the Dow Jones experienced its biggest one-week rise since 1974.

The point here is this: absolutely no one, even star fund managers, can time the market. So, a better strategy in the long term is normally to ‘stay invested’.

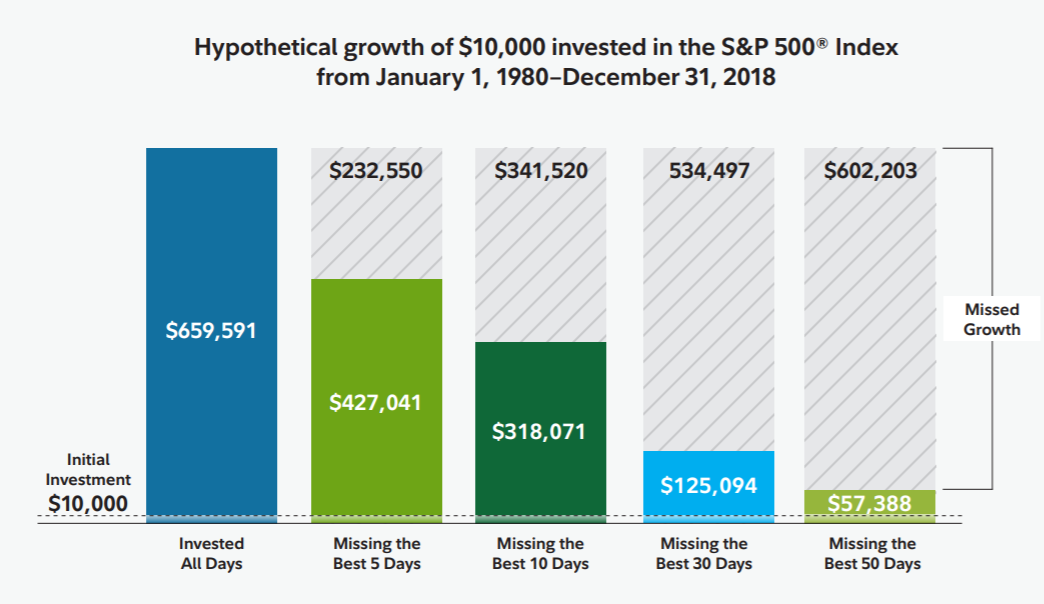

Here’s an example from the US. Here, Fidelity looked at how $10,000 would have grown had you invested it in the S&P 500 Index from the start of 1980 to the end of 2018.

Source: Fidelity. The hypothetical example assumes an investment that tracks the returns of a S&P 500® Index and includes dividend reinvestment but does not reflect the impact of taxes, which would lower these figures. “Best days” were determined by ranking the one-day total returns for the S&P Index within this time period and ranking them from highest to lowest.

Had you left your $10,000 (around £8,050) invested throughout that entire period, it would have been worth $659,591 on 31st December 2018 (around £531,350).

Had you pulled your money out of the market and missed just the best five days during that 38-year period, your total investment would be worth $427,041. You would have sacrificed $232,550 (more than £194,000) simply by being out of the market for five days.

If you had missed the best 30 days between 1980 and 2018, your $10,000 investment would be worth just $125,094 (around £100,770) on 31st December 2018. You would have sacrificed $534,497 of gains – around £430,580 – by being out of the market for just 30 days.

The conclusion to draw is that trying to time when you enter and leave the market can have a significant impact on your returns.

5. Save for longer

One of the main factors that will help you become financially independent is to save for longer. There are two ways you can do this:

Work for longer

Every year you work, the following happens:

- One more year of saving for your retirement

- One more year of compound returns for the money you have already saved

- One less year of spending the money you have saved

Your assets have more time to grow and compound, and they’ll have to fund your life for less time.

Start saving earlier

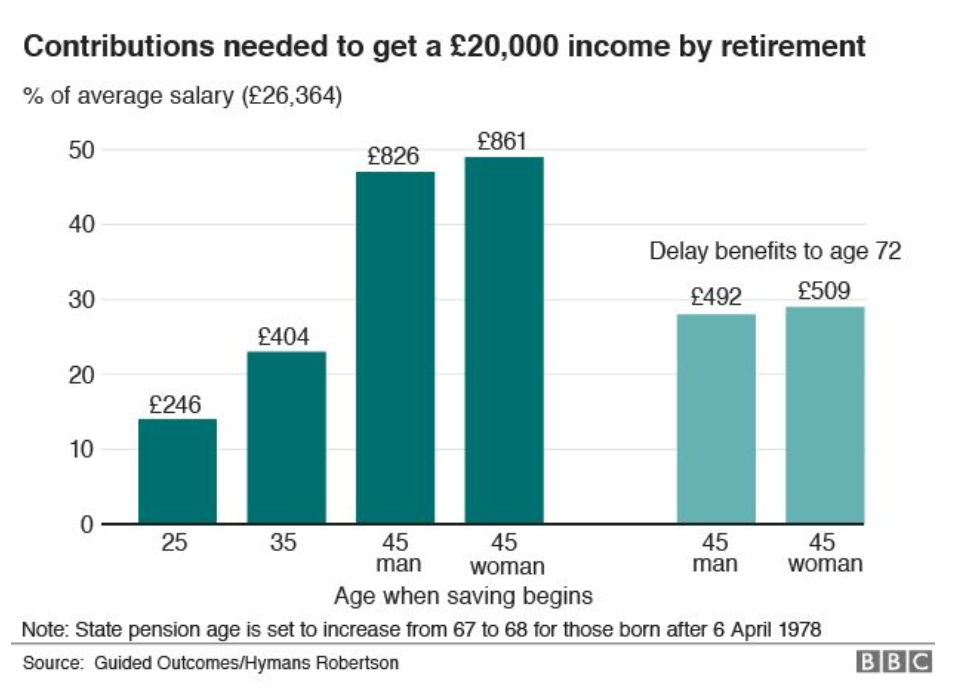

Back in 2017, the BBC asked a firm of actuaries to undertake some calculations to establish how much an individual would need to save each year to generate a retirement income of £20,000. Here are the results.

Of course, starting early means you have more time to save and so your contributions would naturally be lower. However, starting early means you also benefit from compound interest. Saving more, and letting it compound, allows your pension pot to grow.

…and the one lever you can’t control

According to figures from the OECD, a 65-year-old man in the UK can expect to live, on average, for another 18.8 years. A 65-year-old woman can expect to live a further 21.1 years.

If you retired at 65 and passed away at 67, my job as a financial planner – to make sure you had enough income in retirement – would be pretty easy. However, the chances are that your retirement fund is likely to have to last for 20, 30 or even 40 years – particularly if you decide to retire early.

Of course, we can control our lifestyle – what we eat, how much exercise we do – but we don’t know when we’re not going to be around anymore. So, planning for the best-case scenario is key.

Get in touch

If you want to have a chat about your financial plan or you’d like advice on meeting your goals, please give me a call on 07769 156 250.

The value of your investment can go down as well as up and you may not get back the full amount invested. Potential investors should be aware that past performance is not an indication of future performance.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.