Who wants to be an ISA millionaire?!

Do you remember the former Army Major Charles Ingram on ‘Who wants to be a millionaire’? He correctly answered the million-pound question, but instead won a 20-month suspended prison sentence and a bill for thousands in legal fees! There could, however, be an easier way to make a million…

No ‘lifelines’ necessary, no coughing accomplice in the audience – you could be an ISA millionaire.

First, a quick reminder of the basics. An ISA (Individual Savings Account) is a tax-free savings wrapper, free of Capital Gains Tax on growth and Income Tax on withdrawals. ISAs have been around for 20 years now, first introduced with an annual contribution limit of £7,000. But that cap has generously increased over the past ten years. Today, you can save £20,000 a year in ISAs, and it’s been that high since 2017/18.

There are currently four main types of ISA available:

- Cash ISAs

- Stocks and Shares ISAs

- Innovative Finance ISAs

- Lifetime ISAs

You can invest across all types if you want, but the £20,000 limit is shared between them. To keep the maths simple, let’s focus on the traditional Stocks and Shares ISA for our million-pound portfolio.

Making your million

We’ve discussed the relevance of compound growth before, where investment gains attract gains of their own. Over time this can have a profound effect on the value of your savings. Naturally, the sooner you start saving the better, but exactly how long might it take to become an ISA millionaire?

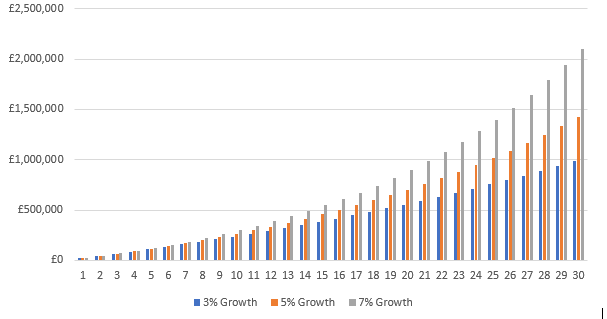

The graph below shows what would happen if you invested your full £20,000 ISA allowance at the beginning of each tax year and includes monthly compound growth. The age-old disclaimer will get a mention here; past performance is no guarantee of future results, but in our hypothetical world, if your ISA returned just 3% p.a. growth, you’d have a million-pound ISA portfolio in a little over 30 years. A 30-year-old with no previous savings, taking very little investment risk, could hypothetically have a million-pound ISA in time for retirement!

If we’re a little more ambitious with the growth rate, you can see that 5% p.a. would deliver a million-pound portfolio in just under 25 years – five years less and with £120,000 less contributions.

Better still, 7% p.a. growth (which is perfectly realistic, depending on your attitude to risk) sees the one million milestone passed at the beginning of the 22nd year. Significantly, that isn’t just relatively quickly in the grand scheme of life, you will have contributed £180,000 less than at 3%! With a regularly reviewed portfolio, even taking into account a potential recession, the million pounds ISA is certainly achievable.

Of course, these figures assume you have £20,000 readily available to invest every April. And it’s worth bearing in mind that inflation would erode the buying power of your savings. I’ve written about the ‘silent wealth killer’ quite recently. But it doesn’t take into account the ISA limit potentially increasing. If it does and you have disposable income, a million would be reached even sooner.

Becoming an ISA millionaire isn’t just an attractive proposition for new savers. You may well be an experienced investor with a diverse portfolio. That doesn’t mean the tax benefits don’t still apply, and, some circumstances may even force your hand towards ISAs.

The next best pension supplement?

For high earners, the attraction of ISAs may be influenced by increasingly strict pension allowances.

The most you can tax-efficiently pay into a pension annually is £40,000. It used to be as high as £255,000 less than a decade ago. Worse still, if you earn over £150,000 your £40,000 Annual Allowance is subject to tapering. For every £2 of ‘adjusted’ income over £150,000, your tax-efficient pension contribution limit decreases £1. This can make your allowance as low as just £10,000 if you earn £210,000 or more.

In this circumstance, ISAs are often the next-best, straightforward, alternative. With your tapered pension Annual Allowance, you could tax-efficiently save £30,000 a year, meaning your million-pound portfolio (with a little help from compound growth) would be achieved even quicker!

Ultimately, there is no one-size-fits-all solution, but you must admit, over the long term the numbers to become an ISA millionaire are compelling. No matter what stage in your life you are at, or your existing level of savings, let’s try and build that million together!

All the figures shown are for illustrative purposes only and are based on the assumption that the compound growth rates used remain unchanged throughout the term of the savings.

The value of an investment can go down as well as up and you may not get back the full amount invested.