Beer, Brexit and the silent wealth killer

Don’t worry, this isn’t a Brexit heavy post, but it is relevant. You’ll see why shortly.

The silent wealth killer? Well, that’s the unseen force in wealth building; inflation. It’s silent as rates usually evolve so slowly, banks don’t warn you about it and neither does the regulator, the Financial Conduct Authority (FCA).

Unlike the immediate effect and visibility of market gains, investment risk and taxation, the current rate of inflation attracts very little attention in the UK. But, it can have a significant and direct impact on your future financial security.

Figures from the Office for National Statistics (ONS) show that the rate of inflation for May 2019is 1.9% (the Government’s target), meaning prices are 1.9% higher than a year ago. Over the past five years, it averaged just 1.6%, peaking at 2.8% and dipping as low as 0.2% in 2015.

What about beer?

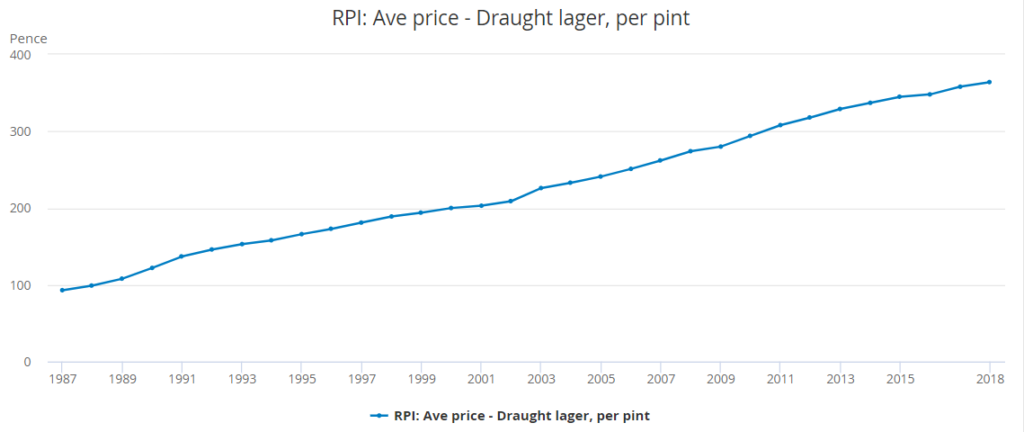

This graph shows the average price of a pint since 1987:

Source: ons.gov.uk

For May 2019, the ONS report the average price of a pint to be £3.69 (wishful thinking in the City). In 2009 it was approximately £2.80, meaning the cost of draught lager has increased 32% in ten years.

Or, to put it another way, if you tucked £10,000 under your mattress in 2009, inflation will have eroded the spending power of that cash by 861 pints!

Incredibly, in the grand scheme of world economies, 861 ‘lost’ pints over ten years is comparatively small – sometimes inflation can spiral out of control. The most recent instance of hyperinflation happened in Zimbabwe, where the rate peaked at 79.6 billion per cent month-on-month in 2008 – shops had to re-price their stock several times a day! In 2009, the Reserve Bank of Zimbabwe abandoned its currency altogether, opting for a multi-currency economy predominantly using the US Dollar.

The Brexit effect

Back in the UK, political and economic uncertainty has led some risk-averse investors to hold large sums of cash in an attempt to avoid market volatility. But, cash is an asset, not an investment. As the increasing price of a humble pint demonstrates, its value erodes over time.

The most generous easy access cash accounts only offer 1.5% interest, meaning that if the rate of inflation remains 2%, cash is effectively worth 0.5% less in a year’s time. Rather than investment risk and volatility, inflation means that in the long term, cash is almost certainly going to lose value.

Post-Brexit, depending on the ultimate deal (if there is one), things could get even worse for cash-rich savers. In a ‘no deal no transition’ scenario, the Bank of England predict inflation will rise to between 4.25% and 6.5%. Based on this prediction, in a worst-case scenario, an item that cost £1,000 today would cost £1,065 in 12 months’ time.

Ignorance isn’t bliss

It’s not only attempting to avoid investment risk that is eroding people’s wealth, some are simply not paying enough attention to their savings. This is especially prevalent with pensions, as the FCA discovered last year. The Retirement Outcomes Review found several worrying scenarios where investors were unwittingly exposing themselves to inflation.

Overall, 33% of people who didn’t seek financial advice and were drawing an income from their pension were wholly holding cash. As you can retire from age 55, that could potentially mean decades of inflation eroding their pension income. The FCA report suggested that someone who wanted to spend their pension over a 20-year period, could increase their expected annual income by 37% if they invested in a mix of assets, not just cash.

Exacerbating the situation further, they discovered that some providers were defaulting consumers into cash or cash-like assets when they began taking income. Solely holding cash in your pension might be appropriate if you are intending to withdraw it over a very short time frame. But, it’s really not suitable in the long term, as your retirement is highly likely to be.

What should you do?

The inherent danger of not taking any investment risk is the effect of inflation over time. Cash should make up a share of a well-diversified portfolio, but holding large sums to protect wealth is counterproductive in the long term.

Market volatility, to some extent, is inevitable. But, time proves that markets recover. After the financial crash of 2008, markets dropped dramatically, but rebounded in around a year. ‘Time in the market, not timing the market’ is an expression you’ll hear frequently, for good reason.

If you’re saving long term the foundation of financial advice remains the same; identifying your circumstances, risk tolerance and objectives, then making regularly reviewed recommendations to achieve those objectives. Your financial plan remains as relevant as ever, no matter what the political and economic climate, holding only cash and attempting to second guess the market is pretty much impossible.

Don’t let the silent wealth killer erode your purchasing power. If you have cash or poorly performing investments that need reviewing, don’t hesitate to pick up the phone.

The value of your investment can go down as well as up and you may not get back the full amount invested.

Accessing pension benefits early may impact on levels of retirement income and your entitlement to certain means tested benefits.

Accessing pension benefits is not suitable for everyone. You should seek advice to understand your options at retirement.

These investments do not include the same security of capital which is afforded with a cash based savings accounts.