Why understanding how markets work can be the key to investment success

The decision to set money aside for your financial future, in the form of pension contributions, and other savings, is an easy one to make.

However, the follow-up choice of where to actually put your money can be far more problematic. A knee-jerk response is often to consider a savings account offering a certain rate of interest on your money. Yet, evidence shows that investment in stocks and investment funds will outperform money in an interest-bearing account in the long term.

But, stock market investments are remarkably misunderstood, especially given that stock markets have been around for close to 500 years.

Given how important investment is in helping you grow your wealth, it’s important to understand what it is, what it isn’t, and how it functions.

The danger of market scare stories

To my mind, one of the biggest barriers to stock market investment is the financial media.

The long-term idea of investing money clearly doesn’t appeal to the media obsession with instant news and fear-driven stories.

For example, while researching this article, I ran a Google search for “Billions wiped off shares”. It threw up a series of articles published in the last couple of years, such as:

- inews: “Billions wiped off shares and markets hold their breath as US debt deadline approaches.”

- The Guardian: “More than £75bn wiped off FTSE 100 amid Credit Suisse crisis.”

- Sky News: “Billions wiped off the FTSE 100 as fears of inflation-led recession fuel global sell-off.”

- The Independent: “Billions wiped off FTSE 100 in worst day for 20 months.”

To my mind, it’s lazy journalism. For one thing, there must be decent alternatives to “wiped off”. More importantly, you don’t see similar articles in the event of positive economic news stating that billions have been added to share values.

Those kind of stories feed common misconceptions about stock market investment. They underline the point that an important part of investment success is being able to tune out the short-term hype and focus on your long-term goals.

Preconceived ideas can create a mistrust of stock market investment

Even though most of your investing will be in collective funds rather than individual shares, there is still a tendency to see investment as a share value that rises and falls, with little understanding as to why.

Many people also see stock markets as a form of casino, with the implication that only the expert “gamblers” ever truly make a profit by fleecing the less experienced.

The latter idea has been fuelled in past decades through the unscrupulous, and highly publicised, activities of financial crooks such as Bernie Madoff, Robert Maxwell, and Allen Stanford.

A series of Hollywood films have added to this preconception. For example, Wall Street, The Wolf of Wall Street, and Boiler Room all promote the stereotypical image of frantic traders in coloured jackets shouting at each other, rather than the reality, which is that investing money should be, and is, quite boring really.

Believing these ideas to be true means you’ll be less likely to behave in a disciplined manner when market volatility inevitably arrives. If the guy on screen, or people writing the newspaper headlines, are getting excited at the first sign of turbulence, surely you should too.

You invest in many of the aspects of your daily life

The first step towards correctly understanding the stock market is to become aware of the company shares you are actually buying, because they are companies you interact with daily.

Consider this scenario:

Your partner phones you on your Vodafone mobile and asks you to transfer money from your HSBC account to their NatWest account so they can pay Howdens for the new kitchen units you’re having fitted.

They also ask you to stop off at Sainsbury’s on your way home to cover food shopping until your Ocado delivery later in the week, and Next to collect the new clothes they’ve ordered.

On the way home, you pull into a Shell petrol station to fill up and admire the Rolls-Royce at the next pump. With your petrol, you also buy a can of Coca-Cola.

As of September 2023, all 10 companies in that scenario – companies that you come across almost every day – are listed on the FTSE 100. According to the London Stock Exchange, in November the total market capitalisation, or value, of the companies listed on the FTSE 100 was over £1.8 trillion. Global PEO Services figures show that in 2022, only seven countries in the world had a GDP in excess of that figure.

So when you’re investing, you’re actually putting money into well-established companies with a track record of growth and business success.

Then, rather than thinking simply in UK terms, you can expand your investment horizons and look globally.

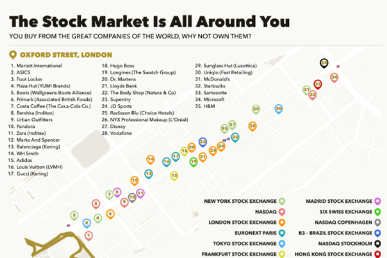

This map of Oxford Street in central London reveals that 35 of the biggest retail outlets are listed on some of the largest stock markets in the world.

Then there are other companies you interact with. The ones that make the pills you take for a headache, design and manufacture the plane you fly on to go on holiday, and built the house you live in and the office you work in.

The nature of the capitalist economic model is that companies are incentivised to increase the revenue and profits generated by their products and services. Those profits are then reinvested for business growth and distributed to shareholders as dividends.

The key to investment success is adopting correct behaviours

As you’ve already read, a distrust of stock markets can result in you making poor decisions that can lead to financial loss.

In contrast, if you have an understanding of how markets work and what they’re made up of, you’re far more likely to invest for long periods with confidence.

Over extended periods, markets increase due to higher corporate earnings and dividends. By staying invested during the inevitable – but short-term – downturns, you have a greater chance of enjoying lasting success.

Get in touch

If you’d like to talk through any of the issues you’ve read about here, then please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Pension income could also be affected by interest rates at the time benefits are taken.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.