What will you spend your money on in retirement?

In one of my previous articles, you read about why you shouldn’t underestimate the cost of your retirement and why planning ahead and budgeting can be so important.

As a follow up to that, this article should help get you thinking about how much income you’ll need once you stop working, and some of the key factors that could dictate your financial commitments.

How you plan your time will be important

A point I made quite strongly in the previous article was that an assumption that your outgoings will automatically decrease once you retire is often an erroneous one.

At a very basic level, while you’re working, you aren’t spending money. But once you retire you’ll have more time on your hands and spending money will become easier. At the same time, you’ll have more free hours to fill.

It’s important to be aware of this as you plan your finances in retirement. While the temptation – and the means – will be there to spend a lot of money, the key point is to try and find a balance between high- and low-cost ways of filling your time.

The alternative could be that you jump into a lifestyle that is beyond your means, which could easily result in future financial challenges if you deplete your retirement fund.

Overseas travel will be an inevitable consideration

It’s likely that the biggest discretionary call on your retirement spending may be overseas travel. With fewer pressing commitments, you’ll have the time to start visiting some of the places you’ve previously been unable to because of work and family.

If that’s your plan, then you won’t be alone! A Sun Life survey of those approaching and already in retirement revealed that 58% of people saw holiday overseas as a top priority.

While you were working, you might not have had the time for periods abroad of anything more than a fortnight, or maybe three weeks if you were lucky. But with no such restrictions, it’s inevitable that your travel plans could become more complex and allow you to enjoy more and/or longer holidays.

Indeed, research by Inspired Villages reveals that nearly a quarter of retirees go on holiday five or more times each year. Furthermore, it also confirms that, if cost was not an issue, retirees would substantially increase the length of their overseas travel from 11 days to three months for each trip.

Your household costs could increase after you retire

Even with longer holidays factored into your plans, once you’ve retired it’s likely you’ll be spending more time at home than you would have done during your working life.

This could well result in increased gas and electricity bills, as you’ll have to heat your home for longer periods during the day rather than just morning and evening.

It’s also possible that the amount you spend on home maintenance will increase as you get older.

Although you will probably have more time on your hands to sort out DIY jobs yourself, there could come a time when you’ll be less able to manage more strenuous activities, and doubtless less keen to climb a ladder to carry out tasks like clearing drains or painting external windows.

This may result in you needing to pay someone else to carry out household maintenance and repairs, which will mean extra financial commitments.

The three ages of retirement

Another important consideration when thinking about your spending in retirement is that it’s unlikely to remain consistent throughout your retirement years.

Many financial advice and consumer finance sites, such as Unbiased often split this into three phases:

- The years immediately after retirement when you are enjoying activities you’ve been looking forward to while you’ve been at work. At this stage, you are likely to be relatively healthy, so you’ll be wanting to enjoy an active lifestyle while you can.

- Your “middle retirement” period when you’ll start to become less active and will be seeking a comfortable and more relaxed lifestyle. Long-distance travel will be less likely, and you’ll establish a steady retirement rhythm with maybe just the occasional large financial outlay.

- The third phase, during which substantial discretionary spending commitments will be less common, but you may face increased outgoings on health and care costs.

You could see this as a smile-shaped spending pattern. High initially before gradually falling to a low point in your “middle retirement” before potentially rising again in later years to cover the cost of care provision – either domiciliary or residential.

Quantifying the cost of your retirement

Clearly no two retirements are the same. Your plans will be unique to you, and dependent on your personal wants and needs. They are also liable to require amending as your circumstances and financial commitments change during your retirement years.

However, you may find it useful to have an outline idea of how much a typical retirement lifestyle will cost.

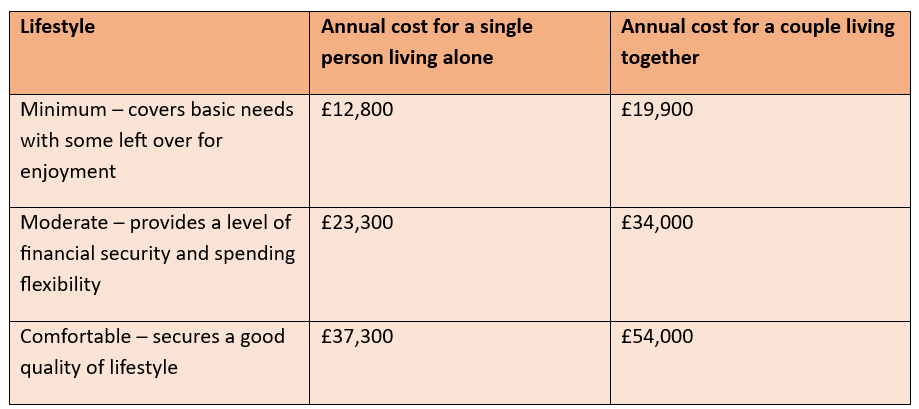

Ongoing Retirement Living Standards research carried out by the Pensions and Lifetime Savings Association (PLSA) reveals the latest average cost of three example lifestyles.

Source: PLSA

Clearly these figures are only illustrative, and your own circumstances will dictate how much retirement income you will require. But they give you a useful idea of the levels of income needed to meet different retirement lifestyles.

It’s important that you have a flexible retirement income plan

As you can probably appreciate from reading this article, planning your retirement income strategy may not be as straightforward as you first thought.

The flexibility provided by Pensions Freedom legislation that came into force in 2015 can make it easier for you to plan your income to suit your needs than may have been the case previously.

Rather than being stuck with a fixed level of income you now have the option to draw income flexibly from your retirement fund while leaving the remainder invested for long-term growth.

Against this, however, you will need to ensure that your income in retirement keeps pace with inflation. Because of this, you’ll need to ensure you have a robust plan in place to manage your income after you stop work and are effectively living on your accumulated wealth.

Get in touch

If you’d like to talk through any of the issues you’ve read about here, then please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Pension income could also be affected by interest rates at the time benefits are taken.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.