Taking stock: your mid-year financial review and a look at what’s ahead

The halfway point of a calendar year is a good time to take stock of what happened during the first six months.

After all, learning from the past is often a useful discipline when it comes to helping you navigate the financial challenges you may face in the future.

So, read my analysis of some of the key economic activity you’ve experienced so far in 2023, and what you might expect to see before the year is over.

July can be a better time to take stock than January

Although the start of the calendar year is the traditional time to read articles about what to anticipate in the coming months, actually focusing on financial issues in any detail can sometimes be a struggle at that time of year.

After all, you have just got through the festive period and back into the cold reality of short days and long nights. As a result, it’s understandable if you’re tempted simply to hunker down and look forward to brighter times, rather than face up to the challenge of any detailed financial analysis.

So, arguably, a better time to do this is in July, when it’s sunnier, and you’re likely to be more relaxed and in a better frame of mind.

However, from the point of view of reviewing your own finances, there’s no harm in doing so at both times of year. Reviews regularly produce positive results, both in terms of knowing you’re on track – but also flagging up potential issues that need to be addressed immediately, rather than left to fester.

The current period of financial headwinds is not over yet

William Arthur Ward, one of the earliest motivational writers, once wrote that “the pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

Given that, it’s often sensible to instil a sense of realism into your thinking, so that – to follow Ward’s analogy – if there are sails that need adjusting then it’s done sooner rather than later.

Two big challenges that could necessitate this at the moment are inflation and interest rates.

As I was writing this, the Guardian reported news of the latest inflation figures, showing a welcome fall in the Consumer Prices Index (CPI) to 7.9% – a welcome sign that we’re heading in the right direction now.

Furthermore, if this fall in inflation is followed by others of a similar size, it’s possible that the Bank of England base rate may not go much higher than the 5% it reached in June.

The investment story so far this year

After inflation and interest rates, the third key indicator it’s traditional to refer to in reviews of this kind is investment markets.

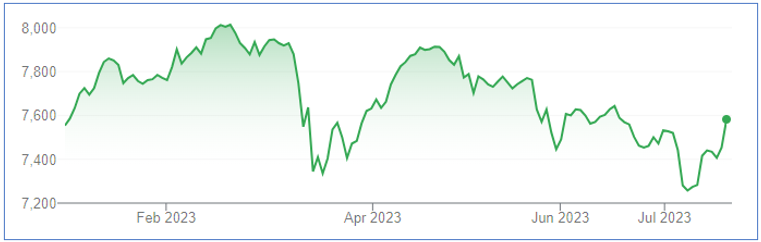

For that, there are two charts for you to look at.

The first shows the performance of the FTSE 100 – an index of the 100 largest UK companies by market capitalisation – since the start of the year. As you can see, after a turbulent ride, we are back close to where we started on 1 January.

It’s important for you to bear in mind that six months is a very short time frame when it comes to investing. However, if you set it against the current bleak economic background, and the fact that this chart does not include any reinvestment of dividends, it can be seen to paint a relatively positive investment picture.

Source: Google.com

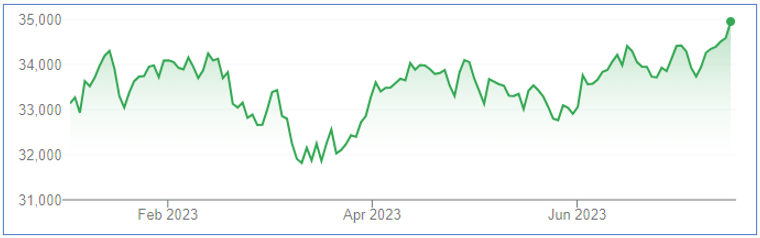

The picture gets even brighter with the second chart below. This is the Dow Jones Industrial, an index of 30 prominent companies listed on stock exchanges in the United States.

Given that most investment portfolios typically hold stocks across a wide range of regions and sectors, this gives you a wider market context since the start of the year.

The overall growth of 5.48% is healthy – again with the caveat that this is over a very truncated investment period – and doesn’t take into account any dividend reinvestment.

Source: Google.com

One key takeaway from this is that when it comes to investing your money, doing nothing can sometimes be the best thing to do.

For example, the plethora of bad economic news could well have prompted you to consider your investment strategy and adjust it to reflect a reduction in market confidence.

Whilst it could be appropriate to review your investments in the light of serious economic upheaval, a kneejerk decision to adjust your portfolio is rarely the right thing to do.

If you’d sold up on the basis of anticipating further investment headwinds, you would have some catching up to do, and potentially dented your long-term plans.

Looking at the months ahead

The threat of a UK recession in 2024 still looms, although a recent report from the CBI suggests this may be avoided – although they predict very low rates of growth.

Even if the UK can avoid recession, a lack of meaningful economic growth can result in reduced business confidence, which in turn can supress further long-term growth.

However, I feel that the underlying message from what we’ve seen so far this year is that the current turbulent headwinds won’t last forever (they never do).

As you’ve already read, inflation is on the way down, which is good news generally, and could be a big positive if you have a mortgage and are concerned about a continuing rise in the cost of borrowing.

Investment markets will continue to be volatile because that’s what markets have always been. The very nature of them means they reflect the continual movements in financial wealth, business, and consumer confidence.

The key point is to remember that investing is for the long term, and if you have hold a well-diversified global portfolio, you will be suitably placed to ride out any short-term volatility’.

Get in touch

If you’d like to talk through any of the issues you’ve read about here, then please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you do not keep up repayments on your mortgage, your home or property may be repossessed.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.