How cashflow forecasting helps you plan your financial future

It’s impossible to predict the future.

External events can happen without warning and threaten to blow even the best plans off-course. For example, who could possibly have predicted the recent pandemic and the effect it had on our lives over a two-year period?

Your personal circumstances can change at short notice too. You may be offered a great employment opportunity abroad that you weren’t expecting or – on the other side of the coin – you may find yourself out of work for a brief period.

Not knowing what will happen can make it difficult to plan for the future, particularly for long-term objectives such as your retirement.

However, by using a process known as cashflow forecasting, you can get an idea of how your financial future may look, and how unexpected events could affect your plans.

It’s very much at the centre of everything I do for my clients to help them build their financial plan and review it on a regular basis.

Find out how it works, some of the key benefits, and how it can answer many of the questions you may have when you’re planning your future.

Detailed financial information is input into the forecasting tool

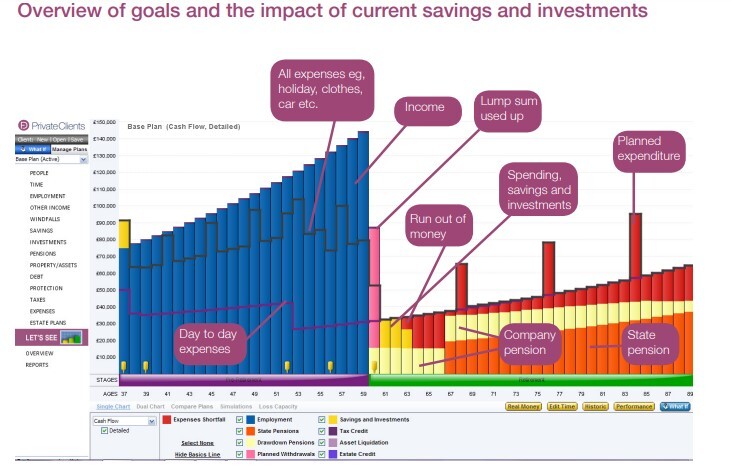

Cashflow forecasting involves using sophisticated financial modelling software.

To get started, you provide full details of your finances that we’ll then input into the software. These details will include:

- Information about your income and expenditure, such as your monthly salary and any other sources of income

- Full details of your regular outgoings

- Details of all your assets, including property, investments, pensions, and savings

- A summary of your current and future liabilities including your mortgage and other loans, as well as ongoing commitments such as childcare costs.

Then we’ll input other assumptions. These will consist of variables that will have an impact on your financial situation, such as current and projected rates of inflation, your expected salary progression, and your expected longevity.

The cashflow forecasting system will then produce a bespoke report, or series of reports, which will illustrate potential outcomes for you.

5 key benefits of cashflow forecasting

There are many benefits of using cashflow forecasting. Five of the most important are:

- It helps you make informed decisions about your financial future and understand the impact of potential choices you face.

- You benefit from a clear idea of what you need to do to meet your financial goals and the retirement you want.

- It raises any red flags about your current lifestyle and spending.

- You can better stay on track to achieve your goals and understand changes you may need to make.

- It provides informed forecasts about the impact of future scenarios and unexpected life events.

Although a lot of the data produced will be related to your eventual retirement, cashflow forecasting can also be an invaluable aid to your Inheritance Tax (IHT) planning and your investment strategy.

Ultimately, it means that your financial plans are made from a position of informed strength rather than guesswork.

Forecasting can also help answer many of the questions you may have

At nearly all the meetings I have with my clients, they will ask me lots of questions. The cashflow forecasting tool can help answer many of these.

Some questions will have positive connotations. For example, you may want to know if you can retire earlier than you’d originally planned.

Based on the information provided, the modelling tool will be able to give you a good idea if that’s currently possible and, if it isn’t, the steps you need to take in order to achieve that goal.

Likewise, you might want to find out if you can afford to give your children money to help them get on the housing ladder. Again, cashflow forecasting will suggest how doing this could affect your current and future finances.

It can also help address concerns you may have over what will happen in the event of your death – especially if this is unexpected and if you are the main breadwinner in your household.

The forecasting output is only as good as the information provided

IT experts have a well-known saying they often use when asked about the effectiveness of software: “rubbish in, rubbish out.”

The same can be said when it comes to assessing the accuracy of the information you get from cashflow forecasting.

If the information put into the forecasting tool is inaccurate, out of date, or incomplete, it makes the output equally unreliable.

For this reason, it is important to provide as much accurate data as possible when using cashflow modelling.

After that, given that forecasting will play an important role in your regular financial review, you should also make sure that you keep providing up-to-date information as your circumstances change.

Modelling “what-if?” scenarios

In my experience, cashflow forecasting really comes into its own when you start considering various “what-if?” scenarios.

Most systems enable you to change future variables to see how they affect your forecasts.

For example, when the war in Ukraine started, a period of high inflation was predicted due to the expected increase in fuel costs.

I was able to use cashflow forecasting to help clients assess how this would affect them, and whether any changes to their plans or future lifestyle were necessary.

A valuable aid to your retirement decision-making

Cashflow forecasting is most useful when looking at your future wealth and planning for the time when you stop work.

Most importantly, it can help give you a clear idea of when you’ll be able to retire comfortably, and when your accrued retirement fund will provide you with the income to enjoy the quality of lifestyle you’ve planned for.

That’s why it’s key that cashflow forecasting sits at the heart of your financial plan.

Get in touch

If you’d like to know more about cashflow forecasting and how it could help you, then please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.