Why now is a good time to be alive

Financial planning is all about looking forward rather than back. For example, one of the big financial risk warnings is based around past investment performance being no guide to the future.

But at times like this, when the economic news is woeful, it can be salutary to stop and look back to see how far we’ve come.

Living, as we do, in a time of 24-hour news and instant social media assessment, there’s always a danger of just seeing things in the here and now rather than in a wider context.

So, as an antidote to the doom and gloom bombarding you right now, read on to see things in a more historical context, and discover why the present day is a good time to be alive.

We’re living in challenging times

Any honest assessment of the UK economy at the moment would conclude that we’re going through a phase of some difficulty.

Last month, annual inflation reached a 41-year high of 11.1% and the Bank of England (BoE) has warned that the UK could face recession throughout 2023 and into the first half of 2024.

In his autumn statement on 17 November, the chancellor, Jeremy Hunt, set out a series of measures that will result in an increased tax burden for most people in the coming years.

On top of all that, the war in Ukraine shows no sign of ending any time soon, and we’re still getting over the after-effects of a once in a lifetime global pandemic.

All this will likely be having a detrimental effect on your household budget and personal finances.

However, if you take a step back and look at the present day in a wider, historical context it’s possible to see things in a much more positive light.

The historic increase in longevity has been startling

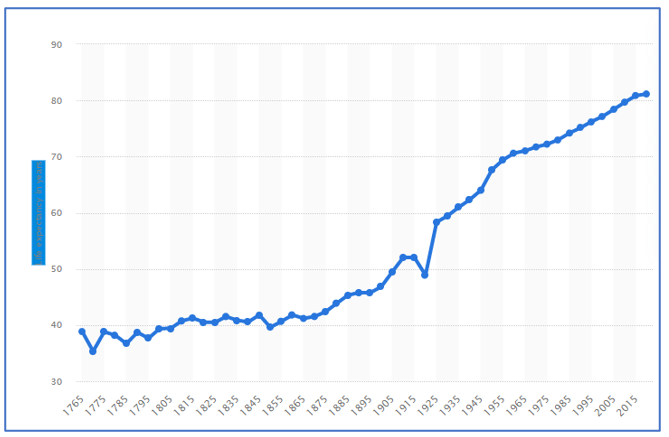

The chart below shows UK life expectancy from 1765 to 2020. Barring one precipitous fall due to the first world war and subsequent Spanish flu epidemic, longevity has risen steadily since the middle of the 19th century.

Source: Statista

This rise has been driven by a number of factors including:

- Effective vaccines, such as those for smallpox and polio, and advances in cancer treatment

- Improvements in public health and sanitation

- The creation of a healthcare system based on need rather than ability to pay.

It’s only relatively recently that retirement planning became a popular concept. After all, when the first UK State Pension was introduced by the Liberal government in 1908, payment started at age 70 when average longevity was barely 50 years.

From a financial planning perspective, increased longevity, and the fact that you can live a relatively normal life with an illness that would previously have killed you, raises issues around long-term care.

But that’s a good issue to have compared with previous generations for who many serious medical diagnoses would have been terminal.

Educational standards and literacy rates have both increased

Even centuries after the invention of the first printing press, books were still reserved for the affluent. To be able to access written knowledge, you had to be born to the right parents or attend one of a highly selective number of schools.

It was really only in the last century that the mass production of books led to a dramatic expansion in written knowledge.

Likewise, it took until the Butler Education Act in 1944 for everyone to have free access to educational opportunities.

Today, the knowledge accessible through the internet is immeasurable.

Older financial advisers have told me about the problems they often had accessing financial product details and investment data.

Nowadays, that kind of information is available at the click of a button. It’s a situation that makes planning your financial future much more straightforward, time-efficient, and effective.

Property and investments are more accessible

With Christmas on the horizon, it’ll soon be time for festive films. One of the very best is A Christmas Carol, with Alistair Sim in the role of Ebenezer Scrooge.

One jarring, and salutary, scene shows three people dividing the possessions of someone who has recently died between them. All the possessions can be fitted in a bag the size of a pillowcase.

It’s a simplistic point, but in the Dickensian era many people lived hand to mouth and didn’t have possessions beyond those required for their day-to-day living needs.

Within living memory, property ownership was reserved for the affluent, and few people were able to save money for anything more than maybe a holiday and Christmas.

Now, buying a property is a reality for most people, notwithstanding current supply issues that have caused values to inflate.

Saving and investing money for your future is now a similar reality, natural and accessible. Whereas buying shares and other investments previously necessitated a laborious process through a stockbroker, now you can do it at the touch of a button.

The perspective of time

At the recent Remembrance Day ceremonies, you would have been reminded that all the veterans of the first world war have now died. The numbers who took an active role in the second world war are reducing every year.

Those generations also had to face many of the problems you’ve already read about – reduced longevity, poverty, and poor access to education and information.

As someone born after 1945, you’re in the fortunate position of being able to read about the hardships of history, rather than having experienced them.

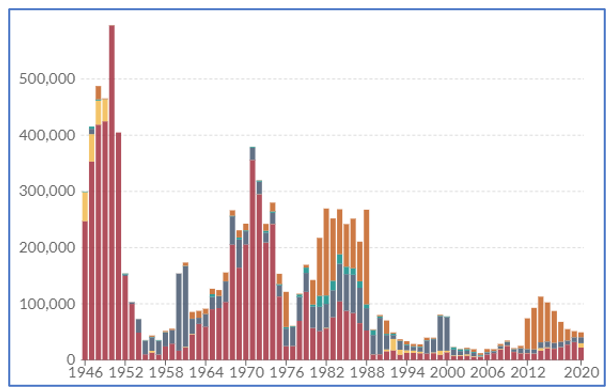

You’re also in the fortunate position of living in a time of relative peace compared to previous generations. Government statistics confirm that only 7,190 UK military personnel have died in conflict since world war two. As you can see from the chart below, the number of war deaths worldwide has been noticeably low in last three decades.

Source: ourworldindata.org

There are many reasons to be cheerful

Technological advances mean that planning your financial future is a relatively straightforward process.

They also mean you can live a life, before and after retirement, that previous generations could only have dreamed about.

Educational advances have increased the wealth of knowledge and made the advances in technology possible. They have also enabled all of us to expand our personal knowledge and skills.

Advances in healthcare mean that we’re living healthier lives and living longer, so you should be able to enjoy the rewarding retirement you’ve worked hard for.

If at times we struggle with current challenges, they pale into insignificance compared with those faced by our ancestors.

Get in touch

If you’d like to talk about your retirement plans, then please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.