Why you should avoid checking your investment portfolio (too much)

Here’s a story I’ve shared with you before, but it bears repeating.

At a financial services event a few years ago, an experienced adviser told the round-table discussion I was involved in that he was convinced that the growth in an investment portfolio was in inverse proportion to the number of times the client checked its performance.

Clearly, he was exaggerating for effect. But while he didn’t have any empirical evidence supporting that claim, there’s a strong element of truth in what he said.

Read on to find out why, often, the best thing to do with your investment portfolio is to ignore it.

Markets are volatile by their nature

Share prices are based on the performance of individual companies and affected by wider economic sentiment. You only have to read the business news, or look at the share price ticker on a financial TV channel, to realise that these prices can change on a minute-by-minute basis.

Companies, and sectors, can have good times and bad. This can create volatility that, in turn, affects markets and investment funds.

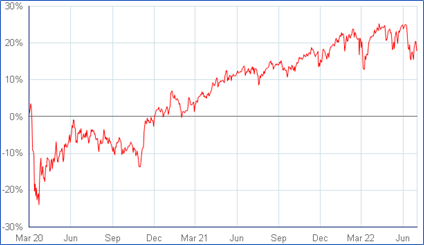

External events can also affect market and investment values. Take a look at the chart below.

Source: Trustnet

This shows the dramatic decline in the value of the FTSE 100 at the start of the Covid pandemic in March 2020. Within a fortnight the index had fallen by more than 20%. As McKinsey and Company reported a year later in February 2021, “the first month of the crisis, saw historically large and rapid declines across all sectors.”

If you’d been checking the value of your investments at that time, it’s likely that at some stage you’d have been tempted to meddle with your holdings in a bid to avoid any further losses.

But now look at another chart.

Source: Trustnet

This brings the FTSE 100 index up to June 2022. It shows that, despite the initial fall during the first Covid lockdown, the FTSE 100 has recovered to the level it was in March 2020, and has exceeded this by around 20%.

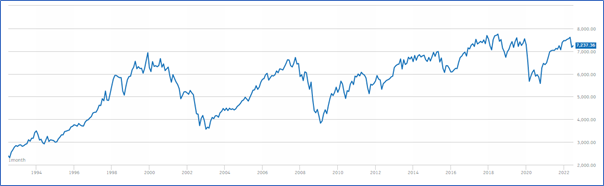

Here’s one final chart to reinforce the message.

Source: London Stock Exchange

This shows the performance of the FTSE 100 over the last 30 years.

You can still see the market shock caused by the pandemic along with other periods of turbulence along the way. But the long-term outcome is that the index has risen from 2,312 on 1 August 1992 to 7,239 on 1 July 2022.

Not only that but, over that period, many blue-chip companies have paid healthy dividends to shareholders to increase the value of their investments over that period.

Short-term volatility should not guide your investment decision-making. Sudden rises can create a false euphoria, while similar falls in value can prompt unnecessary panic.

The paradox of information availability

It’s salutary to compare the availability of data for investors between 1992 and the present day.

Back then you’d have had to buy one of the broadsheets to check the value of the FTSE 100 index, or watch the evening news and wait for the words “in the city today…”.

Only a couple of the broadsheets carried individual share and fund prices.

Compare that to what’s available today. Press a couple of buttons on your phone and you have access to a wealth of investment information including real-time share prices and up-to-the-minute fund values.

The advance in technology is clearly good from a tracking and transparency perspective.

But the other side of the coin is that it simply fuels your nervousness. Having information at your fingertips 24/7 means you could be encouraged to tweak your investments when such action can be counter-productive and – in extreme circumstances – injurious to your wealth.

Don’t believe the hype

One key to maintaining a long-term perspective is making a conscious effort to tune out short-term noise.

You should always have it in your mind that investing money is a long-term game. Anyone who seems to be looking for quick gains is far more of a speculator than an investor.

You can read any number of websites and newspaper columns that will make investment suggestions. Many will predict which markets and sectors are liable to show a big profit or loss in the near future.

When it comes to managing your money and, by extension, your future wealth, it’s important to remember that you aren’t speculating. Instead, you have a long-term plan to help grow your wealth and you should make every effort to stick to it.

Compounded growth and share dividends will typically have a far greater impact on the value of your portfolio – meaning you don’t need to check the performance every day or week.

Get in touch

If you want to talk about your investment strategy, please get in touch.

You can call me on 07769 156 250.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The information contained in this article is based on the opinion of Foster Denovo and does not constitute financial advice or a recommendation to suitable investment strategy, you should seek independent financial advice before embarking on any course of action.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation & Trust advice and Will writing.