“Mind the gap” – 7 reasons why the average investor underperforms the market

Every year, leading investment analysts Morningstar publish an important research report entitled “Mind the gap”.

This compares the difference between the returns the average investor receives from investment funds and the actual performance of the same funds.

According to the latest report, investors earned a 7.7% return over the 10 years ending on 31 December 2020. The actual funds they were investing in produced a 9.4% annual total return over the same period.

Thus, investors suffered a 1.7% annual return shortfall, or “gap”, due to mistiming their investments into, and withdrawals from, the same funds.

Similar research caried out by Dalbar, Inc , a company that studies investor behaviour and analyses market returns, shows that, for the 20 years ending on 31 December 2019, the Standard and Poor’s (S&P) 500 Index averaged a return of 6.06% a year. The average equity fund investor earned a market return of only 4.25%.

The impact of the gap

It might help to quantify how an annual 1.7% shortfall can dimmish the value of your investments.

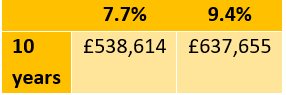

The table below shows £250,000 invested over 10 years, not including charges or fees, getting the two investment returns highlighted in the Morningstar research.

Source: Calculatorsite.com

That’s a shortfall of nearly £100,000 in 10 years.

On your pension fund, it could be the difference between you being able to live comfortably in retirement, rather than having to constantly watch your spending and rein in your impulses.

Here are seven of the reasons why so many investors are underperforming the market.

1. Forgetting investment aims, or not having them at all

As with any key project, if you’re investing money, you need a plan.

This will provide a set of aims and personal goals at outset that you can refer back to and refine as you go through your investment journey. These will then inform your investment decision-making.

Your investment aims will be based on a series of factors including:

- Your attitude to investment risk

- How long you’ll be investing for

- Your capacity for monetary loss

- How your investments fit in with your wider financial planning.

It should take careful analysis and consideration to put together a robust portfolio. It shouldn’t be something that you cobble together in half-an-hour.

Once you have a plan in place, you then need to stick to it.

Too many investors are swayed by short-term movements in the value of their holdings. The temptation is to over-manage, switching investments and trying to chase losses rather than simply remaining patient.

2. Listening to investment tipsters

Investment managers have support from teams of researchers who will pore over business data before deciding where to invest.

Yet, in spite of this advantage, Business Insider reported that nearly 90% of actively-managed funds failed to beat the market over a 15-year period up to 2020.

So, if most fund managers with their inbuilt advantage of research and resource facilities can’t beat the market, what makes you think the average investment tipster – in a personal finances supplement or on an investment website – is going to do any better?

They might strike lucky once in a while – and they’ll be sure to widely publicise their success. But you won’t hear so much about their less successful investment hunches.

3. Ignoring one of the golden investment rules

I’ve mentioned this on several occasions in previous articles and newsletters over the last couple of years, but it always bears repeating.

One of the golden rules of investing – if not the golden rule – is that investing is all about time in the market rather than timing it.

That is to say that you’re more likely to see the value of your investments rise over an extended period if you leave them alone rather than continually switching your holdings to try and beat the market.

4. Being susceptible to home bias

A report from Quilter fund managers revealed that 64% of UK investors have a quarter or more of their portfolio invested in the UK. Almost 1 in 2 (46%) have more than half their money in UK-based stocks and shares.

The MSCI All Country World Index (ACWI) is used by many experienced fund managers and investors as a guide for asset allocation and a benchmark for the performance of global equity funds.

As of 31 January 2022, just 3.7% of the ACWI was held in the UK. That’s quite a differential.

While is tempting to invest in companies that you recognise, it can be more prudent to avoid an over-concentration in your home market.

5. Putting all your eggs in one basket

The Morningstar research confirmed that investors in funds that combine a variety of investment classes, such as stocks and bonds, suffered losses of just 0.69% over the most recent 10-year period.

Diversification is your friend. By spreading your investments across different markets and asset classes you’re reducing your exposure to market turmoil in one particular sector.

All investment markets are cyclical and they all have their periods of growth and decline. But rarely will all market cycles align.

6. Not investing regularly

The Morningstar research also shows that investors in many sectors would have done significantly better by investing regular monthly amounts rather than one-off lump sums.

Regular investment means you’re buying shares in individual companies or units in particular funds at different prices. This means that you aren’t making big purchases when values are inflated. Instead, you’re getting an average price over an extended period.

7. Not getting advice

Leading fund managers, Vanguard Asset Management have quantified the value of financial advice at an average of 3% annually.

One of the key areas where they believe advice can make a significant difference to your investment outcomes is in behavioural coaching. That’s to say, ensuring you maintain a disciplined approach to investing.

Failing to adopt such an approach underpins most of the reasons for investment underperformance that you’ve read in this article.

Get in touch

If you want advice or guidance regarding your investment planning, please get in touch. Call me on 07769 156 250.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.