Why the amount you save is more important than investment returns

I’d like to start the new year by looking at something that’s ostensibly very simple – saving money.

When you’re saving, there’s a tendency to obsess about investment returns. Often this is driven by media comment and the publicity churned out by investment fund managers.

Previous returns, heavily promoted, on a specific fund can lead to a thought process of “this fund went up 20% last year, so if I invest £10,000 it may well be worth £12,000 by the end of the year.”

Instead, you should look at saving money differently. The amount you save and when you save it is far more important than investment returns when it comes to your future wealth and prosperity.

Saving money is the key to your financial future

Because of its monotonous nature, saving money is sometimes seen as boring. That’s probably why there’s so much focus on investment options and returns, which can be far more exciting.

But when you think about it, because saving is the key to your financial future it’s good that it’s boring. If you want excitement, go parachuting or climb a mountain. When it comes to saving, you should revel in the boredom.

Rather than on how you invest, your focus should be on the amount you save. The more you save, the sooner you’ll achieve full financial freedom and not have to worry about money.

Also, having a decent lump sum behind you can give you peace of mind, help you to turbo-charge your career and increase your future earnings potential.

After all, it’s much easier taking chances – such as setting up your own company – with a sum of money behind you as insurance if you suffer some bad luck. So, early saving will increase the chances of saying “yes” when a lucrative, but potentially risky, opportunity comes around.

2 things you must do before you start saving

Before you really start focusing heavily on saving money, there are two things you must sort out first:

- Reduce or eliminate any expensive debt you have. The interest you’re paying on credit or store cards can be both eye-watering and a terrible drain on your wealth.

- Make sure you have an emergency fund in place. As a rule of thumb, this should be around three months of your net household income.

With those two issues sorted, it’s time to focus on saving.

There’s no “correct” saving rate, but right now yours is probably too low

Having challenged you to focus more on how much you save rather than investment returns, I have to confess that there’s no correct answer to the question of “how much should I save?”

Everyone’s circumstances are different, and external events can also affect the amount you save.

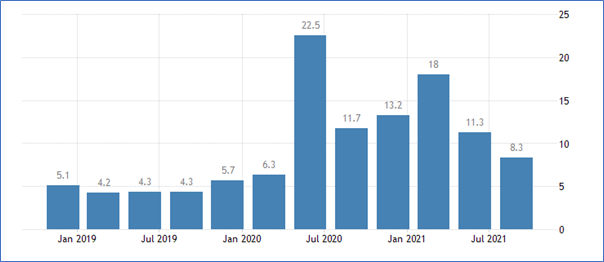

A quick look at the quarterly household savings rate in the chart below shows that the amount people save can vary dramatically and is often driven by external events – in this case the Covid pandemic.

Source: Office for National Statistics

To my mind, the pre-pandemic average of around 5% is far too low. The higher figures we saw during the series of lockdowns since the pandemic started are far more appropriate when it comes to saving for your financial future.

The amount you save in the early years can have a massive impact

Here’s a scenario to help you understand how saving more than perhaps you’re comfortable with in the early years of your savings journey can make a big difference to your final fund.

Three individuals all earn the same annual salary of £100,000.

The first two decide to invest 10% gross of their earnings. Person one gets a return of 10% so at the end of the first year their investment of £10,000 is worth £11,000.

The second person chooses a different investment and gets a better return of 11% and at the end of year one their initial £10,000 is worth £11,100.

The third person chooses the same investment as person one, but decide to stretch themselves and invest 11% rather than 10%. So they save £11,000 rather than £10,000.

Their investment choice isn’t a successful and only gives a return of 7% in the first year. But because they saved more, their fund at the end of the first year is £11,770.

So even though their investment performed quite a lot worse than the other two people, by investing slightly more, they end up with a bigger fund at the end of year one.

(In each scenario we haven’t taken charges or fees into account)

Challenging yourself to save more is important

One of the keys to saving is having control of your finances. This means knowing your income and expenditure each month, and a clear idea of your discretionary spending.

Challenge yourself to save more than you currently do, especially if your current savings rate –including pension savings – is less than 10% of net income.

Three quick tips that can help are to:

- Make sure the amount you save each month comes out of your bank account at the same time as your salary goes in. Don’t fall into the common trap of leaving it until the end of the month to decide how much to save.

- Go through your regular mandates and standing orders and be ruthless with yourself. Clearly some outgoings are essential – mortgage, life insurance, utilities and so on – but do you really need that gym membership and wine club subscription?

- Every time your household income goes up, increase the amount you save.

In a previous article, I stated that the amount you save should make you feel slightly uncomfortable, on the basis that if you find saving easy, you probably aren’t saving enough.

When is the best time to start saving money?

According to an old Chinese proverb, the best time to plant a tree was 20 years ago. The second best time is now.

The same applies to saving money. It’s never too soon for you to start. That’s why a savings habit is one of the best lessons you can instil in young people.

The power of compounding means that the sooner you can start saving, the sooner your money can start working for you. In the same way, the dividends you get on shares you own can help increase the value of your investments.

Compounding means you’re effectively getting “growth on growth”, and automatically reinvesting dividends increases your shareholding on a regular basis.

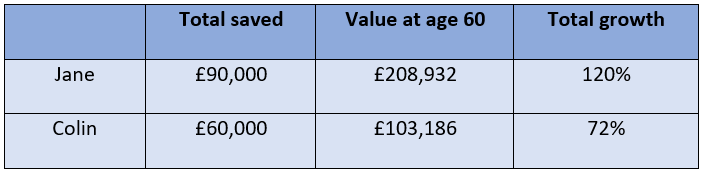

In the table below, Jane starts saving £250 a month at age 30, while Colin waits until he’s 40 before starting to save the same amount. They both get 5% gross return each year. Charges and fees are not included.

Source: Nutmeg.com

Jane has only saved £30,000 more than Colin, but the impact of compounding means the total value of her fund at age 60 is more than double.

Saving money shouldn’t make you miserable

One word of caution I would offer you is, while there’s nothing wrong at all in cutting your lifestyle cloth to suit your means, saving shouldn’t make you miserable.

I’m sure you’ve read lifestyle articles about people who claim to live on nuts and berries in unheated houses, forgoing all luxuries so that they can retire at age 38. Yes, I’m exaggerating for effect, but not by much!

An element of frugality in the early years of your life’s financial journey is inevitable as you get on the mortgage ladder and start building your career. But there’s little point in deliberately making it worse.

Rather than denying yourself the enjoyment and pleasure that give you a healthy work-life balance, one important key to saving is being financially savvy on a simple day-to-day basis.

This won’t involve dramatic changes in your lifestyle. In the same way that top sportsmen look to improve their performance with a series of tiny adjustments to their training and routine, small savings each day can soon mount up and make a real difference to the amount you’re able to save.

Get in touch

If you want to talk through your own plans for saving money and find out how I can help you, please give me a call on 07769 156 250.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Equity investments do not afford the same capital security as deposit accounts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

The Financial Conduct Authority does not regulate school fees planning, taxation and Trust advice and Will writing.