Should I overpay my mortgage or invest the money?

One of the most common questions that clients ask me is: “Should I invest my money, or use it to pay off my mortgage?”

There are typically two reasons clients are considering this:

- They have a lump sum sitting in a low interest account and wonder if they could be doing something better with it

- They have spare cash at the end of every month and are looking for a meaningful way to make the most of this disposable income.

Of course, the answer to this question will vary from client to client. And, it’s not just financial factors that you have to consider, but psychological concerns as well.

What to think about if you’re considering paying off your mortgage

We all know that the last decade has been difficult for savers. Interest rates currently sit at an all-time low, and Moneyfacts recently reported that the average interest rate on an easy-access savings account was just 0.3%. That’s just £30 interest for every £10,000 you save.

Compare this to mortgage rates, and you’re probably paying more interest on your mortgage than you are receiving on your savings. Even if your mortgage rate is very low – it’s possible to fix at less than 2% at the moment – it would seem to make sense to repay the borrowing as the interest you save would be more than the interest you receive.

So far, so straightforward.

However, there are other factors to consider:

- Other debt – You may be paying just 2% or 3% on your mortgage, but do you have other debt? If you have a credit card balance you could be paying in excess of 20% interest. Even personal loans are likely to charge more than your mortgage. So, in this instance, you’d be better off channelling your additional cash towards your more expensive debts and leaving your mortgage alone.

- Early repayment charges – If you’re on a fixed-rate or tracker-rate deal with your lender, there may be ‘early repayment charges’ due if you pay off some or all of your mortgage early. So, you could be penalised for paying back a chunk of your mortgage with your spare savings. Many lenders allow you to pay up to 10% of your annual mortgage balance off each year without penalty, so double-check what you can and can’t do before you decide to pay off a lump sum. You could find yourself having to pay a fee.

- Emergency fund – Any financial planner worth their salt will tell you that it’s wise to have an emergency fund in place, in an easy-access savings account. This is the money you access when your boiler fails, your car breaks down, or you experience a short-term loss of income. Before you pay off your mortgage or invest any money, make sure you have around three to six months’ salary in a rainy-day account.

What about investing the money?

So, you have your emergency fund, you’ve established there are no charges for paying money off your mortgage, and you’ve cleared more expensive debt.

Common sense would then suggest that you’re better off financially by paying off your mortgage than leaving your money in a cash savings account.

But what about investing the money instead?

This is where things can start to get complicated, and outcomes less certain. The truth is that we’re in a period of ultra-low interest rates. It’s possible to fix your mortgage for a decade at around 2-3%, which is unprecedented in modern times. The cost of mortgage borrowing has rarely been lower.

So, could your money make more than 2-3% if carefully invested?

As with all matters concerning the stock market, the answer is ‘perhaps’. Of course, past performance is not a reliable indicator of future performance. And the value of your investment can go down as well as up and you may not get back the full amount you invested.

Historically, however, investing in the stock market has produced solid returns.

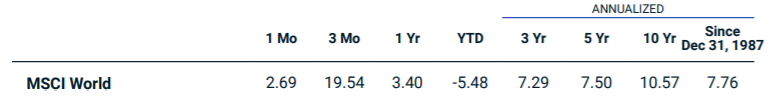

Here’s a look back to the average annualised return of the MSCI World Index – a broad global equity index that includes hundreds of the world’s biggest companies across 23 developed markets.

You’ll see that, over the last decade, this index has returned more than 10% per year. Since its launch at the end of 1987, the index has shown an average annualised return of 7.76%.

If you’re paying a fraction of this as mortgage interest, it therefore could make financial sense to consider investing instead of repaying capital. You could end up making a better return in the long run than the interest you’d have saved if you repaid your mortgage.

If you were considering investing your money in a pension, the returns could be even greater. As well as the investment performance, you also benefit from the tax relief on your contributions. This could mean an immediate 20% boost to your savings, and even more if you’re a higher or additional rate taxpayer.

The psychological aspects

Even if you could work out in pounds and pence whether it was beneficial to invest money or pay off your mortgage, this ignores the psychological aspects of the decision.

Here’s an example. Your mortgage is likely to be your biggest financial commitment. You may have struggled to get onto the property ladder, kept up your repayments during tough times, and would really benefit from the financial security and peace of mind that you owned your home outright.

In this case, the feat of paying off your mortgage might be much more important to you than the financial aspects.

Similarly, if you don’t have a high tolerance for risk, then worrying about how your investments are performing might give you more sleepless nights than paying off your mortgage.

As I mentioned at the start, all clients are different. It’s my job as a financial planner to have these conversations, and to find out what’s really important to you.

If you want to have a chat about your financial plan, or you’d like advice on meeting your goals, please give me a call on 07769 156 250.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.