Coronavirus and your money: What you need to know

We’re currently in the middle of a once-in-a-generation public health emergency. By the end of last week, more than 140,000 cases of the coronavirus had been recorded around the world, with more than 5,300 deaths attributed to Covid-19.

As governments across the world introduce drastic measures to try and contain the spread of the virus, one of the most immediate consequences of the outbreak has been the impact on global stock markets.

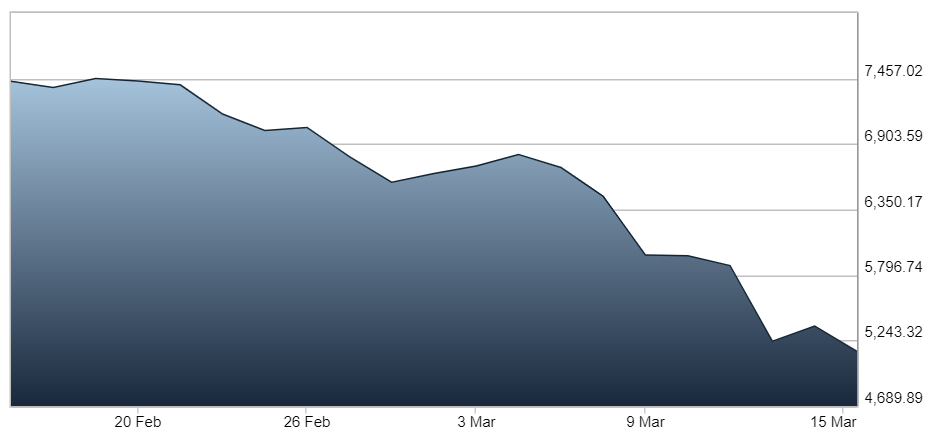

In the month to 13th March 2020, the FTSE 100 lost around 27% of its value.

Source: London Stock Exchange

Indices around the world have suffered similar losses.

However, while you may be justifiably concerned about the short-term volatility of the markets, it’s important to remain calm and focused on your goals.

Keep calm and carry on

Whenever you invest in equities, volatility is something that you have to expect and accept. From the Budget to Donald Trump’s social media updates, external issues can affect what happens to markets. On any given day, week or month, share prices will fluctuate.

For anyone with money invested in the stock market – and I include myself in this – it can be painful to see the value of your portfolio decline. However, if you are aware of a) history and b) human nature, you’ll know that the thing to do now is…nothing.

Right now, there is enough to worry about without making the situation worse through bad investing decisions.

In the longer term, stock markets have typically delivered growth. According to IG, the compound annual return of the FTSE 100 over the last 25 years was 6.4% with dividends reinvested. This would be a total return of 375%.

Here is the year-on-year performance of the FTSE 100 between 2009 and 2018.

Source: IG

Over this ten-year period, the compound return was 8.8% per annum. As a total return that was 121%.

Bear in mind that during March 2009, the FTSE 100 reached a six-year low, trading below the 3,700 mark for the first time since 2003.

Investing is typically a long-term objective. As Mark Fawcett, the Chief Investment Officer of auto-enrolment pension provider Nest says:

“Pension saving is a long game – people can be saving for up to 40 or even 50 years, so it’s important to keep looking at the bigger picture, rather than short-term events.

“Younger savers should comfortably ride out short-term fluctuations and at Nest we take steps to protect members’ pots as they get closer to retirement and are more likely to need their money sooner.”

3 important things to remember

- Your goals are likely to be the same as they were a week or a month ago. An investment strategy is designed with the long term in mind, and this naturally considers periods of both positive and negative returns.

- You have a diversified portfolio. The fall in the value of the FTSE 100 is not the same as the fall in the value of your portfolio. Your portfolio is designed to cope with temporary declines, such as that which we are seeing now.

- Now is the worst time to panic. While normal human emotions such as fear or ‘loss aversion’ might take over at this time, reacting to a fall in the markets can be a disaster. You only ‘lose’ when you sell in a falling market, and a range of studies have found that this is one of the main reasons why investors lose money.

How stock markets have responded to previous pandemics

The final word goes to Charles Schwab who, earlier this year, undertook research into previous disease pandemics and their impact on the global economy. Their conclusion was:

“The global economy and markets have been relatively immune to the effects of past viral epidemics—even when the global economy was especially vulnerable to a shock. A short-term dip in stocks tended to be followed by the continuation of the upward trend.”

If you have any queries about the impact of Covid-19 on investments and pensions, please get in touch.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.