The overlooked hassles of owning property

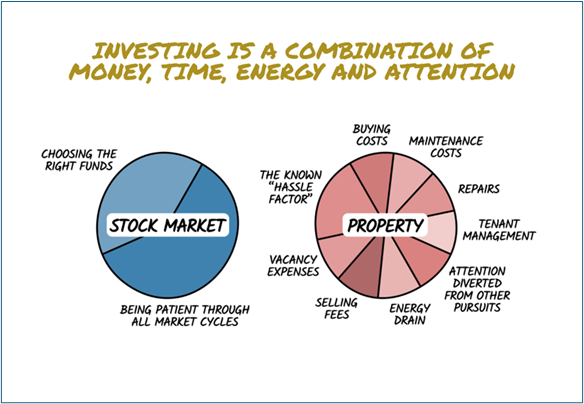

When building your wealth for retirement, it’s tempting to focus solely on the price tag of investments.

However, in doing so, you may overlook a crucial insight: the true cost of owning assets extends far beyond the initial purchase price.

To my mind, sound financial planning involves accumulating assets that provide sustainable, growing retirement income. While the monetary cost is obvious, it’s just the tip of the iceberg. Hidden expenses can significantly impact your wellbeing and financial success, yet they’re frequently overlooked in investment decisions.

In this article, I’ll explore these often-neglected aspects of asset ownership. My goal is to provide a comprehensive understanding of what it truly means to own an asset, equipping you to make informed decisions about investing your money, time, energy, and attention.

Many investors forget to consider ongoing financial costs like storage, maintenance, and insurance. They also overlook the time required to maintain assets, the attention diverted from other pursuits, and the emotional resilience some assets demand.

To illustrate, I will compare two asset classes that are popular with long-term investors: equities (ownership in leading global companies) and residential property.

Examining the full spectrum of ownership costs for each can help guide your investment choices to secure a comfortable retirement.

Equity investment allows you to invest for long-term growth with a diversified portfolio

Owning a diversified equity portfolio requires an informed upfront decision. However, in terms of ongoing costs, it demands very little. Counterintuitively, the less you do, the greater your chances of long-term success.

At most, I’d recommend an annual valuation review and confirmation that the portfolio still suits your needs. Day-to-day, the global companies you own a share of are managed by experienced boards, and your fund is overseen by a professional team of advisers, managers, and custodians.

There is a monetary cost for this advice and management, but the right team can help you to minimise these expenses and provide tremendous value on your road to financial independence.

The one intangible cost of this asset class is the emotional fortitude required to endure the frequent but temporary declines in the value of your portfolio. However, the pain of these declines is likely to be forgotten in time as you enjoy potential long-term gains on your investments.

The cost of owning investment property involves more than simply buying it

The allure of tangible assets like residential properties often captures investors’ imaginations. The ability to see and touch an asset, coupled with the promise of ownership, leads many to equate tangibility with value. However, the picture looks very different if you consider the true cost of owning physical property.

You face not only extensive upfront monetary costs, but also a seemingly never-ending list of ongoing financial demands associated with ownership. These regular costs are often forgotten in the initial analysis of a property’s attractiveness and are frequently left out when calculating the return on the investment.

The costs can include:

- Annual maintenance requirements

- Suitable insurance

- Periods when properties are empty.

In addition, there may be other costs, such as tenant damage and outsourced management.

More worrying, especially for retired investors, is the ongoing “hassle factor” that can take many, often unexpected, forms. Property ownership is a high-hassle game. These intangible costs frequently surpass monetary considerations, impacting investors’ wellbeing and decision-making processes.

If you ever decide to sell, another round of valuation and selling costs awaits you. Furthermore, there is no guarantee that the timing of the sale and the amount accrued will align with your capital or income requirements.

All these factors add layers of complexity that affect not only your financial standing but also your personal stress levels.

It’s important to make informed choices about your investment strategy

While property may be a suitable choice for some investors, it’s important to understand the full spectrum of costs associated with different asset types.

Financial planning involves allocating resources and optimising your time, attention, and energy. By considering all aspects of asset ownership, you can make informed choices that enhance your overall quality of life while securing long-term financial stability.

As you review your investment strategy, consider your financial goals and the time, energy, and attention each asset demands.

Get in touch

If you would like to talk about your own investment plans or any of the issues raised in this article, please get in touch.

You can call me on 07769 156 250.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.