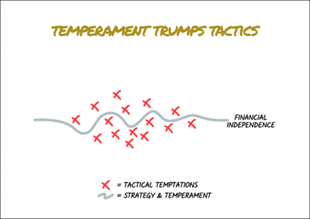

The right temperament will always trump tactical meddling when you’re investing

The world is filled with investors constantly seeking the next winning move.

They watch financial news intently, adjust portfolios based on headlines, and worry about timing each market swing perfectly. For these investors, investing becomes a never-ending series of tactical decisions.

The market turmoil in the wake of President Trump’s imposition of tariffs on many countries has left many of those investors scrambling frantically over the past couple of months, trying to decipher how the tariff uncertainty will end. While markets do seem to have calmed down, there clearly still remains an element of uncertainty, with the suspicion that even those in charge of setting tariff rates do not know what will eventually transpire.

But what if the most important factor in your investment success isn’t your tactical brilliance but something much more fundamental? What if your temperament, derived through your mindset and emotional discipline, matters far more than any short-term adjustment you might make?

In the journey towards financial independence, how you think proves infinitely more important than what you do in response to market movements. This distinction separates those who achieve their financial goals from those perpetually chasing them.

It’s important to appreciate the difference between strategy and tactics

Think of your financial journey as an ocean voyage. Your strategy is the charted course from your current location to your destination. It will include key issues such as your plan for retirement, funding your children’s education, and leaving a meaningful legacy. This strategy reflects your values and unique circumstances.

In this metaphorical example, tactics are the day-to-day adjustments you might make in response to changing conditions, such as adjusting your sail configuration for a passing storm.

While the weather (market conditions) may change dramatically from day to day, your destination remains constant. Unless something significant changes in your life, such as your health, family situation, career, or financial goals, your fundamental strategy probably doesn’t need to change.

Yet, many investors abandon solid strategies in favour of tactical adjustments, often based on nothing more substantial than market volatility or predictions from so-called experts about what might happen next.

Successful investors understand that no one consistently knows what will happen next in the markets — not the economists, not the strategists, not the portfolio managers. Markets are complex systems influenced by countless variables, making short-term predictions impossible and ultimately irrelevant.

You’ll gain an advantage by adopting the right temperament

I believe that once you’ve established a sound strategy, temperament becomes your most valuable asset.

Warren Buffett, arguably the most successful investor of our time, famously said: “The most important quality for an investor is temperament, not intellect.”

But what exactly does the right temperament look like?

It starts with patience, which is letting your investment strategy unfold over time without constant interference. It also includes discipline, sticking to your plan even when emotions urge you to abandon it. Perhaps most importantly, it requires perspective and understanding that market fluctuations (even severe ones) are a regular part of the investment journey.

For example, trying to make tactical changes during the ongoing tariff uncertainty has proven to be a fool’s errand. It’s impossible to know what the next few weeks and months will bring and how markets will react.

Successful investors understand that the path to wealth creation isn’t smooth. It resembles a roller coaster with ups and downs along the way. The key is to stay on the ride.

Focus on controlling what you can

This mindset doesn’t come naturally to most of us. Our brains are wired for survival, not investment success. We feel losses more acutely than gains. We see patterns where none exist. We overestimate our ability to predict the future.

Overcoming these natural tendencies requires emotional maturity that goes beyond understanding investment concepts. It demands self-awareness and the ability to recognise when your thinking is clouded by fear or greed.

It’s natural to seek action. However, the wisest approach is to focus on what you can influence. You can’t control market returns, economic cycles, or global events. But you can control how you respond to chaotic events. During uncertain times, revisit your financial plan rather than the financial news.

In investing, as in life, it’s not about avoiding storms altogether. It’s about building a ship that can weather any storm, and having the temperament to stay the course when the seas get rough.

Your future self, enjoying the financial independence from disciplined investing over decades will thank you for the temperament you cultivate today.

Get in touch

If you would like to talk about your own investment temperament or any of the issues raised in this article, please get in touch.

You can call me on 07769 156 250.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, cashflow planning, tax planning, Lasting Powers of Attorney, or will writing.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.