Why rebalancing is your secret investment weapon

In any investment portfolio, it’s normal to find that one asset class has outperformed the others in the recent past.

Your mind, being an extrapolation machine, will often assume that what has happened in the past will continue into the future.

This can cause you to be drawn to investments that have performed well recently, hoping their strong performance will continue. This behaviour would appear to be unique to investing because, in most other areas of life, you will generally look for good value. So, you’ll rush to the shops when there’s a sale, not when the price has recently increased.

In reality, however, rather than recent price movements continuing forever, investment asset classes tend to “revert to the mean”. Assets that have recently performed well go through a period of disappointing performance, while recent underperformers make a comeback.

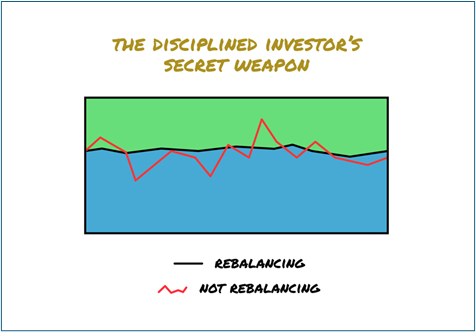

There may be a natural urge to chase performance and take advantage of the market’s cycles, but as a disciplined investor, you have a secret weapon.

Rebalancing will help keep your investment strategy on track

When asset classes experience different returns, it’s normal for a diversified portfolio of equities and bonds to no longer align with your original investment strategy.

Let’s use a very simple example. Say you have a balanced attitude to risk, and so you hold £5,000 in cash and invest another £5,000.

Your equities perform well and make a 10% return in a year. Meanwhile, your cash earns you 3%.

At the end of the year, you have £5,500 in equities and £5,150 in cash. Your portfolio has deviated from your chosen 50/50 balance to 52% equities and 48% cash. Over time, this could deviate further from your chosen position.

This is where rebalancing comes into play. Rather than being tempted to shift more assets into the performing asset class, rebalancing is periodically adjusting your investment portfolio to return to your target mix of assets.

This means reducing the allocation to the asset class that has performed well and buying more of the asset class that has performed poorly.

While counterintuitive, it’s a powerful tool that can help counteract any natural impulse you have and keep your investment strategy on track.

When you rebalance, you sell some of the best-performing assets, which have become more expensive, and buy more underperforming assets that have become relatively cheaper. This systematic approach helps you capitalise on market fluctuations without trying to predict them.

Another significant benefit of rebalancing is that it helps to ensure your investments align with your financial goals and required return. As markets shift and certain assets outperform others, your portfolio can drift away from your original target allocation – as in the example above. Regular rebalancing corrects this drift, keeping you on track with your investment strategy.

Lastly, in a world where short-term thinking often prevails, rebalancing encourages you to focus on your overall investment strategy. It reminds you that investing is a long-term endeavour and helps you avoid reactive, emotion-driven decisions.

Being disciplined can be more effective than trying to make market predictions

Successful investing is about consistency and discipline rather than trying to time the market perfectly. The goal isn’t to predict which investments will perform best in the short term but to maintain a diversified portfolio aligned with your long-term goals. By rebalancing, you’re positioning yourself to benefit when these trends reverse, as they often do over time.

The most straightforward approach to rebalancing is to schedule an annual review of your financial planning and rebalance at that time. The asset classes that have performed better are reduced in favour of asset classes that have underperformed. In effect, you are then “selling high and buying low”.

This is best done with the help and guidance of an experienced financial adviser. As always, your unique goals, circumstances, and tax planning should also be considered.

By working together to implement a robust rebalancing strategy, we can help ensure that your portfolio remains aligned with your goals, regardless of market fluctuations.

Get in touch

If you’d like to talk through your own investment strategy, then please get in touch.

You can call me on 07769 156 250.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Equity investments do not afford the same capital security as deposit accounts.